CIS Contractor’s Monthly Return (CIS300)

by Daniel at Taxfile.

The CIS Contractor’s Monthly Return is a mandatory requirement for contractors operating within the Construction Industry Scheme (CIS). It acts as a mechanism for contractors to disclose to HM Revenue and Customs (HMRC) payments issued to subcontractors and the corresponding tax deductions withheld from those payments. By providing HMRC with information regarding payments rendered and the accompanying tax deductions, the CIS Contractor’s Monthly Return guarantees transparency and adherence to regulations within the construction sector. In today’s guide, we explain the various components of the monthly ‘CIS300’ return, how the process works, key deadlines, the ramifications of non-compliance, and much more.

Key Components of the Monthly Return

The CIS Contractor’s Monthly Return typically includes the following key components:

1. Contractor Details

This section includes information about the contractor, such as their name, Unique Taxpayer Reference (UTR), and contact details. Ensuring accuracy in this section is crucial for HMRC’s records and communication purposes.

2. Subcontractor Details

Contractors must provide details of all subcontractors they have engaged during the reporting period. This includes the subcontractors’ names, UTRs, and payment amounts.

3. Payments Made

Contractors must report the total payments made to each subcontractor during the reporting period. This information helps HMRC track payments within the construction industry and verify compliance with tax obligations.

4. Tax Deductions

Contractors are required to calculate and report the tax deductions made from payments to subcontractors. The deducted amounts are typically based on the subcontractors’ verification status and tax treatment under the CIS.

5. Total Amount Due

The Monthly Return concludes with the calculation of the total amount due to HMRC, taking into account the tax deductions made from payments to subcontractors.

Deadlines and Reporting Periods

The CIS Contractor’s Monthly Return deadlines follow a structured timeline, which includes:

- The submission deadline — contractors must submit their Monthly Returns to HMRC by the 19th of each month following the end of the reporting period. (Contractors’ payments to HMRC must also be made by this date).

- The reporting period covered by each Monthly Return — which typically spans from the 6th of the previous month to the 5th of the current one.

Making Your CIS Payments to HMRC

Once you’ve calculated the total CIS deductions, prepare to make the payment to HMRC. You will need to have the following information ready:

- Your Unique Taxpayer Reference (UTR) number;

- Your payment reference, which is your 13-character Accounts Office reference number followed by the letter ‘C’ (e.g., 123PA12345678C);

- The amount you’re paying.

HMRC offers various payment options for settling your CIS liabilities, which are explained here.

- A contractor who operates as a limited company and also acts as a subcontractor might find that they are exempt from making any payments to HMRC. Subcontractors who do not have gross payment status will incur CIS deductions, which can then be used to offset any CIS payments owed to HMRC. This is exclusively available to limited companies. Please look out for our forthcoming blog focused on the CIS claim — a hyperlink will follow here once it’s live.

Implications of Non-Compliance

Failure to meet CIS Contractor’s Monthly Return deadlines can lead to various consequences, which may include the following:

- Penalties — HMRC may impose penalties for late or non-submission of Monthly Returns, which can escalate over time.

- Loss of benefits — non-compliance with CIS obligations, including Monthly Return deadlines, can lead to loss of benefits such as gross payment status, affecting contractors’ cash flow and competitiveness.

Managing the CIS Monthly Return Process

For contractors, efficiently managing the CIS Contractor’s Monthly Return process involves the following steps:

1. Maintain Accurate Records

Contractors should maintain accurate records of payments made to subcontractors and tax deductions applied. This includes keeping track of invoices, receipts, and CIS statements.

2. Timely Submission

The Monthly Return must be submitted to HMRC by the 19th of each month following the end of the reporting period. Contractors should ensure timely submission to avoid penalties and maintain compliance.

3. Use HMRC Online Services

HMRC provides online services for submitting CIS returns, making the process convenient and accessible for contractors. Registering for and using these online services can streamline the submission process and reduce administrative burdens.

The CIS Contractor’s Monthly Return is the key tool through which to report payments and tax deductions accurately to HMRC. Understanding its components and effectively navigating the submission process helps to ensure that contractors are compliant — and also avoids unnecessary penalties.

Rest assured, though: Taxfile is here when you need help with CIS returns and accountancy for construction workers, bookkeeping, CIS tax rebates for subcontractors, limited company accounts, and any tax-related matters that require professional help. We’re happy to provide guidance on compliance requirements, tax calculations, record-keeping practices, and much more.

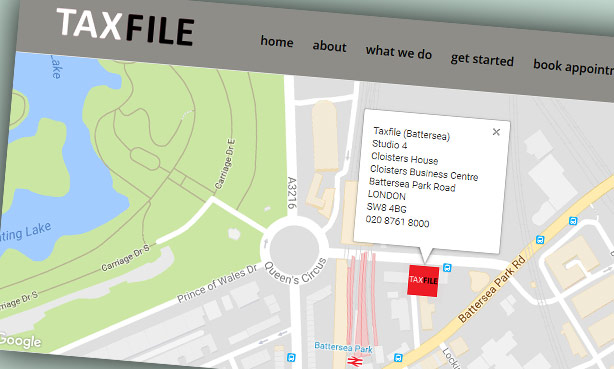

Contact Taxfile

We’re Tax Advisors & Accountants Helping Contractors, Subcontractors & Businesses Across South London

We have accountancy practices in Tulse Hill and Dulwich in South London, plus Devon & Cornwall in the South West of England.

[UPDATED]: Calling all subbies! Claim your refund in time for Christmas AND get a 5% discount on Taxfile prices if you submit your records to us before 21st December!

[UPDATED]: Calling all subbies! Claim your refund in time for Christmas AND get a 5% discount on Taxfile prices if you submit your records to us before 21st December!