How To Help Your Accountant Save You Money

There are many benefits of helping your accountant by providing complete and organised records from the outset.

Here are some of them:

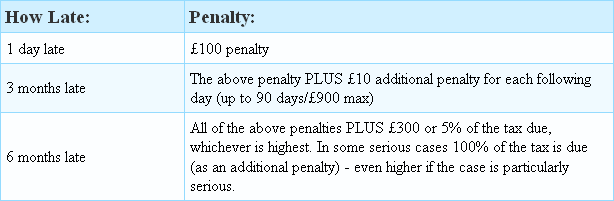

- If you get your records to your accountant on time, you will give them enough time to work on your case without unnecessary pressure and file everything on time (don’t forget you are not their only client).

- By providing organised and detailed records, you’ll understand your business performance better and it will save them time from processing and reorganising untidy paperwork.

- By providing complete records of your business expenses, they can claim what is allowable and potentially reduce your tax bill.

When preparing your financial records you need to remember:

- Separate your business from your personal finances.

- Stay on top of your records and ensure they are orderly with no gaps in the dates.

- Keep receipts and purchase invoices; you will need to provide proof of all expenditure and year-end creditors.

- Bring bank statements for the complete period and downloads of your bank feed in .csv format if possible.

- Sequential invoices for each sale, dated, to prove year-end debtors and accrued income.

- Depending on your business, you may also need to keep records for things such as payroll, cash books, stock takes, travel and credit card statements.

In an ideal world:

- It is much better to keep on top of these things monthly than leaving it until the end of the year, where you may have lost or forgotten data around expenses, sales, or other financial details.

- You would have a software package to help you track your bank, expenses, and sales.

At Taxfile we provide the full spectrum of accountancy-related services; integrating your business with accounting software like Xero, oversee your bookkeeping, run VAT returns and payroll, to filing your year-end accounts, corporation tax return & director(s) tax return(s).

Call us on 0208 761 8000 if you would like to streamline your businesses finances and alleviate some pressures from your financial duties as a director. Alternatively, book an appointment with us here or drop us a message here — we’d be delighted to hear from you.