Every Day of January is the 31st

HMRC have announced that those members of the public not able to pay their taxes or submit tax returns on time will be able to appeal against the late filing penalties they will inevitably get this winter. From what we have been hearing HMRC are expecting everyone to have adequate proof of sickness. Does this mean that they will be expected to waste the time of the medical community who, if I am right, are rather busy these days?

What will happen if tax filers struggle with the HMRC online service and cannot get help over the phone, perhaps because HMRC are closing early, not open over the two Sundays, under-staffed on the helplines and rather strangely make you wait 40 minutes in a queue (which has been the case the past year)?

What are people to do?

Buy last minute accounting software from some of the companies climbing on the band wagon to further stress and pressure people into adopting overbearing products and systems designed for businesses not necessarily for sole traders, who probably use their personal bank accounts to get paid, so have mixed use issues? These software products are now being pedalled to the public as the fix-all solution — but who wants to have all their personal bank info imported into a tax and accounting package? Are people expected to analyse every minutiae and, in doing so, become experts on what they can claim or most likely not claim anyway! Or have to master percentages for use of things such as telephone, Internet usage and then apportion in the software (how does this work if at all)?

When I worked with the office of tax simplification we worked out what was actually happening in society and gave it credence;

- People earn an income from dealing with their clients;

- They may or may not provide materials or use tools;

- They may or may not use transport;

- They probably have some communication and technology costs;

- Then they may have some professional costs like insurance.

It’s hardly rocket science.

When you come to use the HMRC software it leads you through the maze somewhat similar to the psychology of coping with your first orientation of a new Ikea store!

So I can tell you …

- You don’t need accounting software;

- You will not enjoy HMRC self assessment online;

- You may or may not have a healthy and fit-for-purposes tax agent to help you;

- You will not find a local tax office open in your area;

- You will have to wait for ages if you try to get help from software suppliers or HMRC;

- You may not be able to contact your accountant who may be struggling with lockdown lateness.

Why can people not simply fill in the tax return boxes on the tax return form and post it in this year? It could be a simple link that could be promoted through the press at the drop of a hat. It’s the self-employed people of this country who need to raise their voices in complaint …

- What about us?

- What do we represent in society?

- How can we report our circumstances?

- What incentives are there?

- How can we simplify the process?

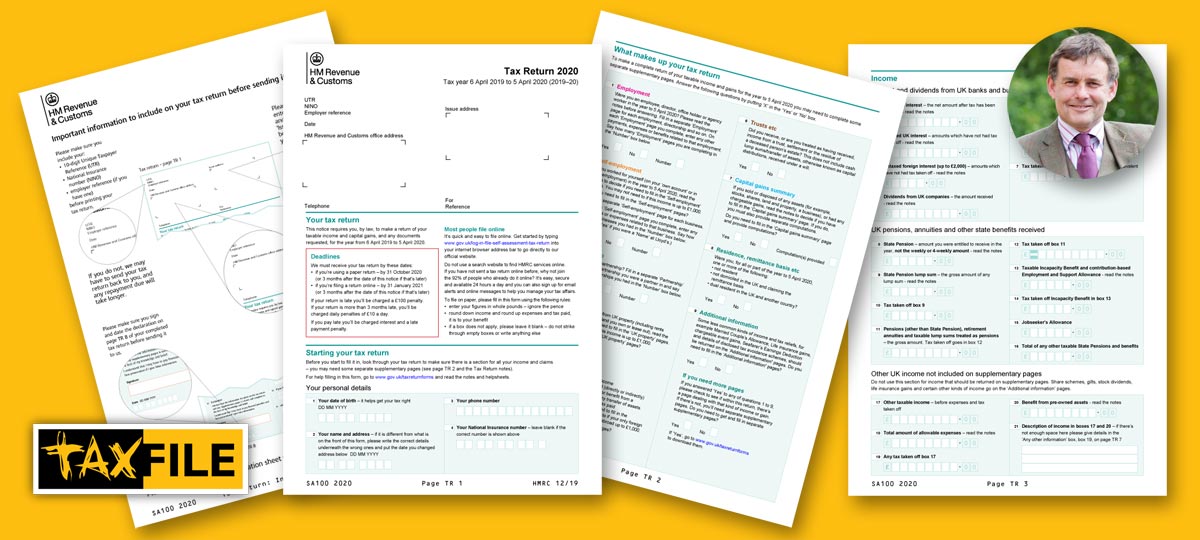

So I return to the form itself. Use it to work out what your tax return will look like. Use the online HMRC calculator to estimate your tax. If you cannot set up your HMRC login because you don’t have a current passport and/or driving licence and you cant pass the credit check, then consider doing something with what you know about yourself and put it onto paper. At least you can show that you tried to do your tax return.

Two requirements:

- WHAT WILL GO ON THE FORM?

- HOW MUCH WILL I OWE FOR LAST TAX YEAR?

Here is a link to a tax return. If you are self-employed or employed you will need the additional pages. The help sheets are all very clear.

I am suggesting that if you are struggling to cope and don’t know who to turn to, then at least fill in a tax return and put in a letter of appeal to say why you cannot cope with the pressure of having to use the system.

** N.B. YOU WILL GET A PENALTY OF £100 ** (Here are the deadlines).

Is it a legitimate excuse if …

- you cannot get through to HMRC helplines?

- you cannot set up an HMRC Gateway I.D.?

- your accountant or tax advisor is sick or unavailable?

- Citizens Advice is inundated with hardship issues?

- tax aid charity are too busy to help?

- low income tax reform group cannot help?

- there is no local tax office?

We can all pepper this issue with complexities and ifs and buts. The administration is the key.

Check out the criteria for appeal for late filing of your tax return (reasonable excuses). Here are the notes.

Let’s go back to basics and allow people to fill in a simple tax return form and send it by post and, if that post is stamped the last day of January, agree it can be accepted as a legitimate effort on the part of the tax payer to comply with the regulations.

There are so many reasons why this should be permitted:

- no fuss;

- simple honest form filling;

- delivered by the post men and women of this country;

- no need to get a test;

- no need to go to the doctors;

- no need to fake sickness to save £100;

- no technology stress;

- no telephone stress.

Download, print and fill in this appeal form. It’s a postal form, so is simple to complete and just needs a stamp.

Guy Bridger and his company Taxfile are the chosen suppliers for tax return help organised by Wandsworth council (which is fully booked) so this advice above is being given as a last resort option for those who are worried about their tax return.