We Submitted Over 400 Tax Returns in January!

Taxfile prepared and submitted more than 400 Self-Assessment tax returns for clients during January. That’s about a hundred a week and goes to show just how busy it gets for us during January, the busiest month in our accounting calendar.

Did you submit your tax return on time?

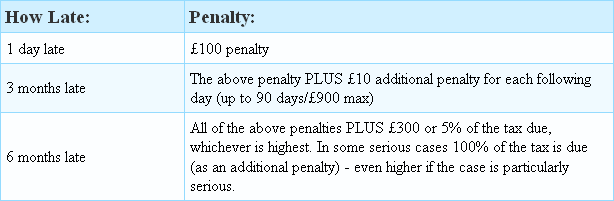

The deadline for submission of your tax return (and payment of any tax due) was 31st January at midnight. Did you manage to submit yours in time? If not, you’re already into the ‘penalty’ period where HMRC basically fine you for being late. The penalty comes in the form of an initial £100 fine but that increases, potentially very significantly, as you get later and later with your tax return submission. If you look at the table below, it’s safe to say that you can end up owing a thousand pounds or more if you bury your head in the sand and are 3 months late, or more. If you continue to leave your tax payment and tax return submission outstanding for six months or more, the penalty is £1300 as a minimum – perhaps more (it depends upon how much tax you owe).

Is your tax return & tax payment late? Taxfile can help!

If you are late submitting your tax return or paying tax and don’t know how to straighten things out, don’t Read more

If you’d like our help with your Self-Assessment tax return, please do try to get your records and figures to us before 10th of January if you want to avoid the last minute rush and save money – there will be slightly higher charges for our help from that date (inclusive). This is to cover extra staff and overtime required during the the final part of January – our busiest time of the year – when we can deal with all the last minute returns for those who have left it until the last minute. So, save hassle, avoid the last minute bottlenecks and also save yourself some money by getting your records and figures to us well before 10th January if at all possible. We can still help thereafter, of course, but it’ll cost you a little bit more.

If you’d like our help with your Self-Assessment tax return, please do try to get your records and figures to us before 10th of January if you want to avoid the last minute rush and save money – there will be slightly higher charges for our help from that date (inclusive). This is to cover extra staff and overtime required during the the final part of January – our busiest time of the year – when we can deal with all the last minute returns for those who have left it until the last minute. So, save hassle, avoid the last minute bottlenecks and also save yourself some money by getting your records and figures to us well before 10th January if at all possible. We can still help thereafter, of course, but it’ll cost you a little bit more.