We Submitted Over 400 Tax Returns in January!

Taxfile prepared and submitted more than 400 Self-Assessment tax returns for clients during January. That’s about a hundred a week and goes to show just how busy it gets for us during January, the busiest month in our accounting calendar.

Did you submit your tax return on time?

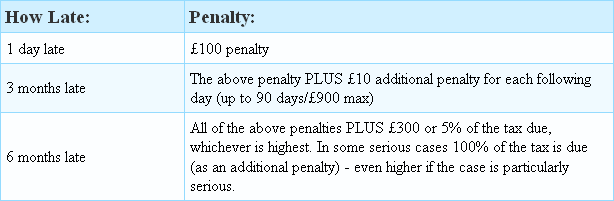

The deadline for submission of your tax return (and payment of any tax due) was 31st January at midnight. Did you manage to submit yours in time? If not, you’re already into the ‘penalty’ period where HMRC basically fine you for being late. The penalty comes in the form of an initial £100 fine but that increases, potentially very significantly, as you get later and later with your tax return submission. If you look at the table below, it’s safe to say that you can end up owing a thousand pounds or more if you bury your head in the sand and are 3 months late, or more. If you continue to leave your tax payment and tax return submission outstanding for six months or more, the penalty is £1300 as a minimum – perhaps more (it depends upon how much tax you owe).

Is your tax return & tax payment late? Taxfile can help!

If you are late submitting your tax return or paying tax and don’t know how to straighten things out, don’t worry — Taxfile can help. Every year we sort such things out for hundreds of customers and get them back on track with HMRC. We also do our best to limit any fine from HMRC if you can prove that you had a good (and eligible) reason for being so late. The reason has to fall within certain guidelines though.

If you’d like our professional help computing and submitting your tax return and getting your tax payments up to date, contact us on 0208 761 8000 or send us a message here. Alternatively, simply book an appointment with us at one of our offices. You can book an appointment at our Tulse Hill office here, our Dulwich office here, our Battersea office here and our Exeter office here. The first 20 minutes is free and we can quote any potentially chargeable work up front, so you know exactly what to expect.