Need a Limited Company? Questions you may be asking yourself

“What are the main differences between being self-employed and running a limited company?”

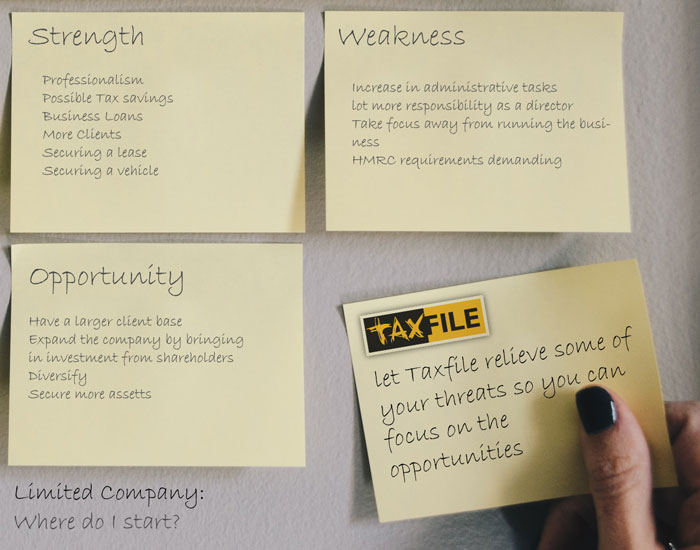

“What are the advantages and disadvantages of having a private limited company?”

The major difference between running a private limited company and being self-employed are the administrative requirements you are required to do by law & although the volume is more, the data contained within those returns are pretty similar to being a sole trader.

A limited company will:

- need to keep company records

- report any changes to Companies House & HMRC

- need to file an annual company tax return along with the company’s accounts, giving an undistorted view of its finances.

So why go through the extra cost and resources of having a Limited Company?

In forming a limited company, you are limiting your personal liability. What this means is that the Limited Company becomes a legal entity of its own. Think of it as another being, that you work for. However, it is important to keep in mind that you cannot abuse your power with the limited liability, to take selfish and unnecessary risks. As a director, you are ethically and morally responsible for the business decisions and transactions the company makes.

As a director of a private limited company you will:

- make decisions that benefit the company rather than your own

- abide by the rules and regulations outlined by the company Articles of Association, which are written rules about running the company agreed by the shareholders or guarantors, directors and the company secretary

- notify any shareholders if you might benefit personally from a company transaction

- always act with the intention of making the company successful.

Having a Limited company can also add professionalism to your business. This can help your business become even more successful because customers, clients, and B2B companies will be more inclined to trust you and buy your products or services if you are a limited company rather than a sole trader. It is quite common for B2B companies only to trade with another limited company as a general rule.

A final benefit is, if you have a profitable Limited Company, how you distribute salaries and dividends can have income tax savings, especially once your earnings are in the higher income tax band.

Your obligations as a Director can be ‘taxing’.

The most important part of becoming a successful business owner is realising that you don’t have to do every single business task all by yourself. You can ask for help. It makes sense to take as much pressure off your shoulders as possible, especially if you know that you are not particularly good at a job.

At Taxfile we can help deliver financial advice and support for small to medium businesses that require accountants to compile and file their full company accounts ready for the shareholders, people of significance to the company, Companies House, and HMRC as part of your company tax return.

We can assist you with the bookkeeping and bank reconciliation to ensure that your accounting records are complete and include:

- all money received and spent by the company

- details of assets owned by the company

- debts the company owes or is owed

- stock the company owns at the end of the financial year

- all goods bought and sold

At Taxfile we can compile and file your company’s tax return as well as calculating what is owed in Corporation Tax (if applicable).

When we file your tax return we calculate:

- profit or loss for Corporation Tax (this is different from the profit or loss shown in your annual accounts)

- Corporation Tax bill

Our SMB Private Limited Company accountancy services will take a lot of the strain away from being a company director, and allow you to focus on why you formed a limited company in the first place, to make a successful and expanding business.

We can help you with all the necessary bookkeeping, computations and filings, as well as advising on other business taxes that may be required such as VAT, and also look after your payroll and expense claims when filing your P11D’s.

Our personable and knowledgeable accountants are real people that you can talk to and meet in person. They are available to answer your questions and offer advice.

We offer accountancy services to businesses spanning the South London area, from Croydon through to Wandsworth. We are your local accountant for small to medium businesses.

If you would like help and advice about forming a private limited company please call us on 020 8761 8000.