A Brit’s Guide to Value Added Tax Returns

VAT — the three little letters that strike fear into the hearts of many a Brit. But fear not, fellow taxpayer! Today, we’re taking a break from the spreadsheets and diving into the delightfully quirky world of UK VAT returns.

VAT, the Shapeshifter

Ever feel like VAT is playing a game of tax-code whack-a-mole? One minute, it’s 20% on your fancy new bicycle helmet. The next, it’s vanished like a magician’s rabbit on a packet of crisps (because, let’s face it, crisps are a VAT mystery all on their own).

The Great Cake Debate

Who knew a simple sponge cake could cause such a stir? Apparently, a sprinkle of chocolate transforms it into a full-VAT situation. Don’t worry, Victoria sponges are safe (for now).

VATman vs. the Smoothie Smugglers

Remember the smoothie wars of ’07? Innocent Drinks tried to claim their creations were “liquefied fruit salad” to avoid VAT. HMRC, ever the defender of fiscal justice, said, “Not so fast, those are clearly beverages!” A tale that proves even the fruitiest tax battles can be entertaining.

Filing Follies

We’ve all been there. You’ve spent hours on your return, feeling smug and self-assured. Then, with a click of the submit button, dread washes over you. Did you forget something? Did you use the wrong form for your pet rock collection (because, yes, VAT rules apply there too)? Deep breaths, everyone. VAT return blunders are a thing.

The Refund Rumble

There’s nothing quite like the thrill of a VAT refund. It’s like finding a forgotten banknote in your winter coat – a financial windfall delivered straight from HMRC! Just remember, with great refunds comes great responsibility (to spend it wisely, of course).

VAT returns might not be a walk in the park, but with a little humour and a helpful accountant, they can be a gentle breeze on a summer’s morning.

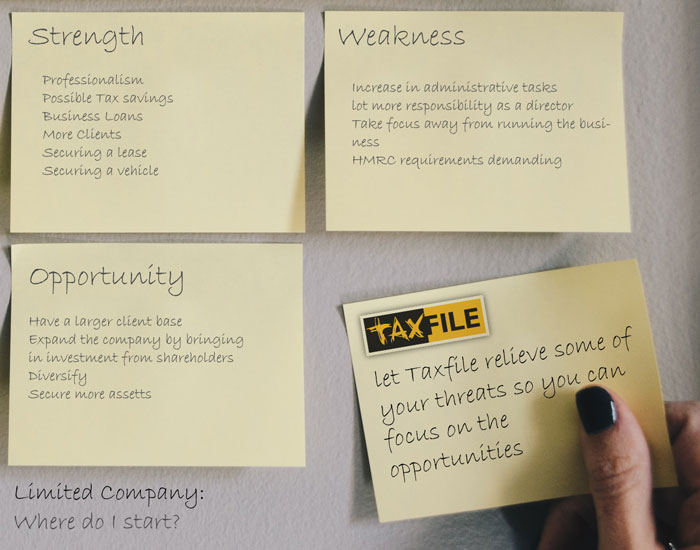

At Taxfile we take the ‘tax’-ing aspect out of VAT returns leaving you with the ‘value added’, focusing on what is important for you and your business.

We can run your VAT from start to finish; all you need to do is keep a digital footprint of your financial data.

For Accounting Help, Contact Taxfile

Call us on 0208 761 8000 so we can provide you with all the services we provide from VAT registration, bookkeeping, MTD-compliant software and those VAT calculations and submissions. The only thing we don’t do is pay your VAT bill for you!