New 30-Day Rules for Capital Gains on Residential Property

New rules have now come into force in relation to capital gains made on disposals of UK residential property*. Several key actions are now required if a taxable capital gain has arisen, including some that now need to be made fast:

- Taxpayers need to report the property’s disposal within 30 days of the actual disposal;

- They will need to pay the estimated Capital Gains Tax (‘CGT’) to HMRC within 30 days of the disposal.

- Those who fill in and submit a Self-Assessment tax return will also need to include details of the disposal on their return.

Who Do the New CGT Rules Apply To?

The new rules apply whether you’re an individual, joint property owner, trustee, partner in a partnership or LLP, or a personal representative.

What Counts as a Residential Property Disposal?

The new rules apply to all UK residential property that was disposed of (taken as the date of the exchange of contracts) since 6 April 2020 inclusive, where a capital gain was made that will require payment of CGT.

To fall within the rules, a UK residential property must be one that:

- is suitable for use as a dwelling, or;

- is being built or adapted for use as a dwelling.

It can be one in which the the owner has never lived or has lived for only part of the period they owned it. It can also be a rental property or a holiday home.

Where a property has been used for mixed purposes, only the capital gain that’s equivalent to Read more

A warning and reminder to landlords: the Chancellor’s Summer budget back in July will hit buy-to-let investors’ profits once the changes kick in, so now is the time to start planning ahead. Not all landlords will be affected though; if their rental property is mortgage free or if they sell within the next 2 years these changes won’t affect them. However those landlords that are Higher and Additional taxpayers will notice their tax relief reduce by 2020. Also, investors near the tax threshold could find themselves in the next tax bracket, which could have a knock-on effect and increase their tax exposure.

A warning and reminder to landlords: the Chancellor’s Summer budget back in July will hit buy-to-let investors’ profits once the changes kick in, so now is the time to start planning ahead. Not all landlords will be affected though; if their rental property is mortgage free or if they sell within the next 2 years these changes won’t affect them. However those landlords that are Higher and Additional taxpayers will notice their tax relief reduce by 2020. Also, investors near the tax threshold could find themselves in the next tax bracket, which could have a knock-on effect and increase their tax exposure.

HMRC are constantly reviewing who has and has not declared income properly from letting out property, whether that’s from short-term lets, long-term lets, holiday lets, letting rooms to students or to workforces. And with new, sophisticated, data sharing systems now in full force across many agencies, authorities, online, via tip-offs and surveillance, the Government has its sights on an estimated 1.5 million landlords who they think have under-paid tax.

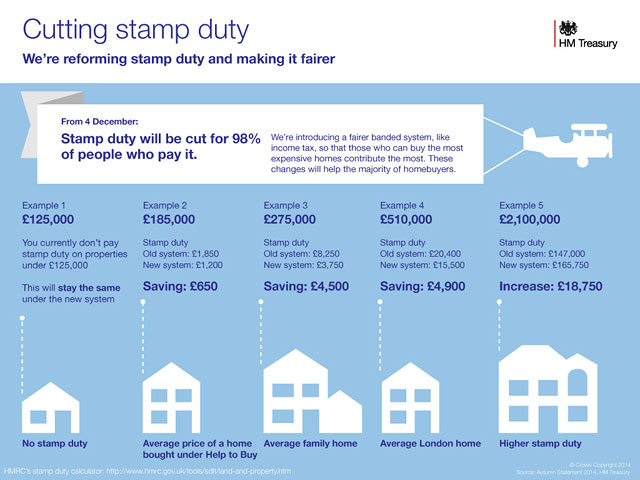

HMRC are constantly reviewing who has and has not declared income properly from letting out property, whether that’s from short-term lets, long-term lets, holiday lets, letting rooms to students or to workforces. And with new, sophisticated, data sharing systems now in full force across many agencies, authorities, online, via tip-offs and surveillance, the Government has its sights on an estimated 1.5 million landlords who they think have under-paid tax. On 5 December 2013 George Osborne, Chancellor of the Exchequer, gave his Autumn Statement in Parliament. Key announcements included:

On 5 December 2013 George Osborne, Chancellor of the Exchequer, gave his Autumn Statement in Parliament. Key announcements included: