The new capital gains tax (CGT) rules will come into effect on April 2020, which will more than likely impact the sales of most additional properties in the UK.

CGT is paid on profits from the sale of investment properties that are not the sellers main place of residence. The amount of CGT paid is dependent on the annual income of the individual. Current capital gains tax rates on property for 2019-2020 are 18% for basic rate taxpayers (£12,001-£50,000) and 28% for higher rate taxpayers (£50,001+).

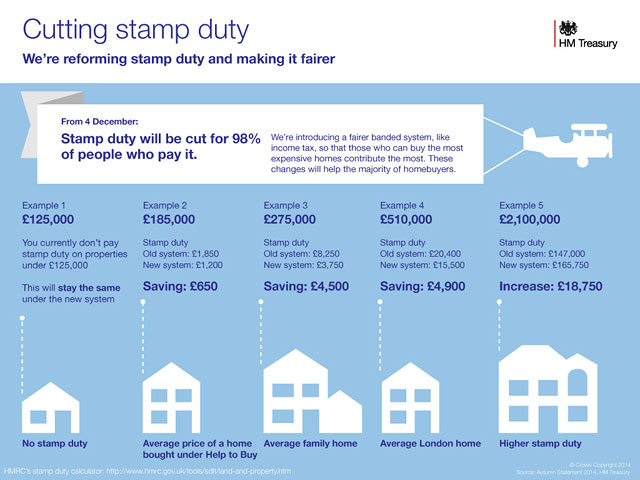

The changes coming into effect in 04/2020 are threefold:

1. The timing of when you pay the CGT to HMRC

2. The amount of tax relief you can claim if you previously lived in the property

3. How the letting relief will work

Timing:

Previously a UK resident CGT has been calculated & submitted alongside their self assessment income tax irrespective of the completion date for the sale of the investment property. From April 2020, sellers will need to pay the full amount owed within 30-days of the completion of the sale and failure to pay within the 30-day limit will result in penalties.

Tax Relief:

The private residence relief (PRR) applies to landlords selling a property where in the past they have used that property as their main place of residence.

Currently, you are exempt from paying tax on the final 18-months that you owned the property, regardless of whether it was being rented. From April 2020 it is expected to be halved to 9-months. So once you have not lived in a property that was once your main place of residence for longer than 9-months, you will probably be required to pay some CGT on the profits when it is sold.

Lettings Relief:

As a landlord, if you have qualified for PRR, then it may also be possible to claim lettings relief.

Letting relief can currently be claimed if you used to live in the property being sold, and have also let out part or all of it for residential accommodation.

You can claim the lowest of the following:

the same as the amount of PRR you will receive

£40,000

the chargeable gain you make from the period you let out the property

When the new rules come in from April 2020, you will only be able to claim this relief if you live there when it is being sold (i.e if you share occupancy with your tenant).

Under current rules there are certain costs that can be deducted from your CGT:

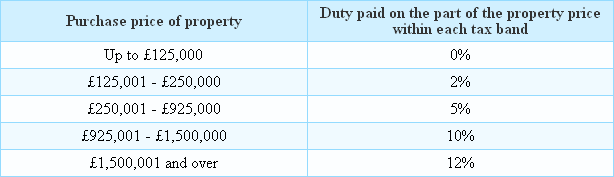

- Stamp duty paid on the purchase of the property

- Estate agent fees

- Solicitor fees

- Improvement costs that added value to the property (such as extensions)

- Qualifying buying and selling costs (such as surveyor fees)

Aside from this, capital gains tax is only payable on property that is owned by individuals. If the property is owned by a limited company, corporation tax is applied instead of CGT.

Corporation tax is currently 19%, but the current government hinted at a reduction to 17% for 20/21 but we await the confirmation from the Chancellor budget due in the Spring of 2020.

If you have any queries around CGT or need an accountant to calculate & submit your CGT, please don’t hesitate to contact us. We offer a free 20-minute consultation.

A warning and reminder to landlords: the Chancellor’s Summer budget back in July will hit buy-to-let investors’ profits once the changes kick in, so now is the time to start planning ahead. Not all landlords will be affected though; if their rental property is mortgage free or if they sell within the next 2 years these changes won’t affect them. However those landlords that are Higher and Additional taxpayers will notice their tax relief reduce by 2020. Also, investors near the tax threshold could find themselves in the next tax bracket, which could have a knock-on effect and increase their tax exposure.

A warning and reminder to landlords: the Chancellor’s Summer budget back in July will hit buy-to-let investors’ profits once the changes kick in, so now is the time to start planning ahead. Not all landlords will be affected though; if their rental property is mortgage free or if they sell within the next 2 years these changes won’t affect them. However those landlords that are Higher and Additional taxpayers will notice their tax relief reduce by 2020. Also, investors near the tax threshold could find themselves in the next tax bracket, which could have a knock-on effect and increase their tax exposure.