Second Property & Rented Property ‘Tax Trap’ for the Unwary

Owners of second properties and let properties need to be aware that HMRC is planning to introduce new rules from 6 April 2020 to require payment of Capital Gains Tax much, much earlier! The window of payment will be reduced from 31 January following the year of the gain to a mere 30 days from the date of the sale.

Effectively, ‘in year’ reporting of the estimated gains – and payment of the tax – is mandatory under the new rules. Failure to report the gains and pay the tax will lead to penalties for landlords and second home owners.

You will only be able to offset losses accrued at the time of the disposal, so losses later in the year will not be available against the payment on account.

Summing Up:

- If you make a capital gain in 2018/19 (before the new rules kick in) you will pay the capital gains tax on or by 31 January 2020.

- For the sale of a house that is let, or a second property, with exchange of contracts occurring on, say, 15 April 2020 with completion happening on 15 May 2020, the Capital Gains Tax (CGT) has to be paid by 14 June 2020. This accelerates the payment of the tax to the Exchequer by 7 months.

- So, perversely, the later year requires the Capital Gains Tax payment before the earlier year, as you can see above!

The other difficulty is knowing what rate to apply because a higher rate taxpayer has to pay 28% on a gain but a basic rate taxpayer has to pay tax at 18% up to the limit of the basic rate band that is unused. This is, of course, one situation where Taxfile can help to work out the tax implications for its customers. Tax calculations are what we do best and we’re here to help you!

Note that Scottish tax rates may vary.

HMRC is currently assessing feedback on their consultation, which closed on 6 June 2018.

If you believe this change of rules is wrong, one option is to write to your MP to complain.

Professional Help with Tax & Accountancy – for Landlords & More

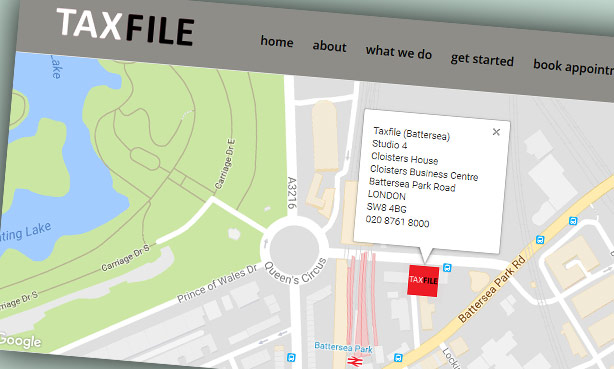

For help with accountancy and tax for any property, lettings or any capital gains situation you may find yourself in, contact your nearest branch of Taxfile. We have London offices in Tulse Hill (SE21), Dulwich, Battersea (SW8) and another in the Exeter in the South West along with additional tax consultants in Carlisle in the North of England, Yorkshire in the North East, Poole/Dorset and Plymouth in the West Country. Call 0208 761 8000 for an introductory chat or appointment, contact us here or click the bold links for more information. We’ll be happy to help and to get your tax affairs in order.