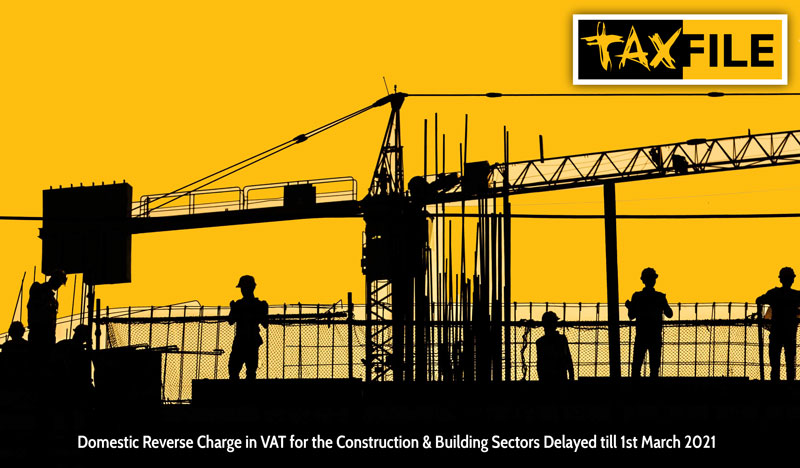

IMPORTANT UPDATE!

On 06/09/2019 HMRC announced that the Domestic Reverse Charge will be postponed for 12 months and will come into effect 01/10/2020. Their official statment;

“To help these businesses and give them more time to prepare, the introduction of the reverse charge has been delayed for a period of 12 months until 1 October 2020. This will also avoid the changes coinciding with Brexit.”

———————————-

From 1st October 2019 HMRC will introduce the Domestic Reverse Charge for VAT returns within the construction industry if certain criteria are met.

HMRC states it is aware of the large scale fraud that has occured within the industry, whereby construction businesses charge VAT for their services but then disappear without paying their VAT bill, taking with them the 5% or 20% as additional profit. They have also managed to under cut their prices against many businesses working legitimately with the knowledge that they will have this additional ‘profit’. Therefore, by moving the VAT charge down the supply chain, HMRC intends to make this kind of fraud impossible.

Any company that is VAT registered and works under the Construction Industry Scheme (CIS) providing the following services may be subject to the Domestic Reverse Charge;

- constructing, altering, repairing, extending, demolishing or dismantling buildings or structures (whether permanent or not), including offshore installation services

- constructing, altering, repairing, extending, demolishing of any works forming, or planned to form, part of the land, including (in particular) walls, roadworks, power lines, electronic communications equipment, aircraft runways, railways, inland waterways, docks and harbours

- pipelines, reservoirs, water mains, wells, sewers, industrial plant and installations for purposes of land drainage, coast protection or defence

- installing heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection systems in any building or structure

- internal cleaning of buildings and structures, so far as carried out in the course of their construction, alteration, repair, extension or restoration

- painting or decorating the inside or the external surfaces of any building or structure

- services which form an integral part of, or are part of the preparation or completion of the services described above – including site clearance, earth-moving, excavation, tunnelling and boring, laying of foundations, erection of scaffolding, site restoration, landscaping and the provision of roadways and other access works

Services excluded from the Domestic Reverse Charge include;

- drilling for, or extracting, oil or natural gas

- extracting minerals (using underground or surface working) and tunnelling, boring, or construction of underground works, for this purpose

- manufacturing building or engineering components or equipment, materials, plant or machinery, or delivering any of these to site

- manufacturing components for heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection systems, or delivering any of these to site

- the professional work of architects or surveyors, or of building, engineering, interior or exterior decoration and landscape consultants

- making, installing and repairing art works such as sculptures, murals and other items that are purely artistic

- signwriting and erecting, installing and repairing signboards and advertisements

- installing seating, blinds and shutters

- installing security systems, including burglar alarms, closed circuit television and public address systems

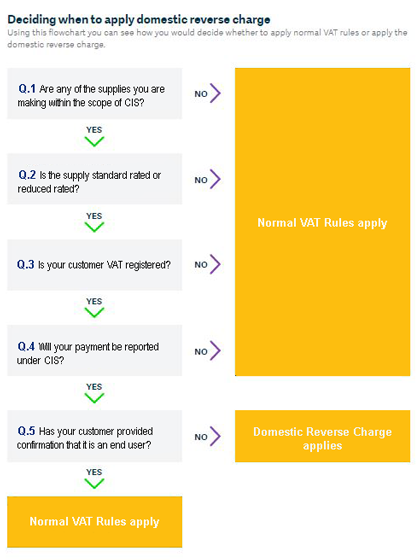

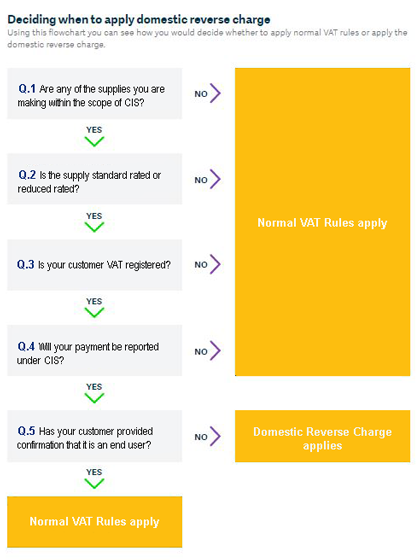

The final criteria is whether the service being provided is to the the ‘end-user’ or ‘intermediary supplier’. If it is then the normal way of charging VAT applies, if not, then the Domestic Reverse Charge applies. Please see the flowchart below to see if the Domestic Reverse Charge applies to you:

What is an ‘End User’?

For reverse charge purposes consumers and final customers are called end users. They are businesses, or groups of businesses, that do not make onward supplies of the building and construction services in question, but they are registered for CIS as mainstream or deemed contractors because they carry out construction operations, or because the value of their purchases of building and construction services exceeds the threshold for CIS.

What is an ‘Intermediary Supplier’?

Intermediary suppliers are VAT and CIS registered businesses that are connected or linked to end users.

To be connected or linked to an end user, intermediary suppliers must either:

- share a relevant interest in the same land where the construction works are taking place

- be part of the same corporate group or undertaking as defined in section 1161 of the Companies Act 2006

It will be your responsibility to ask your contractor whether they are the end user or intermediary.

If they are not, then you will not receive the VAT for the supplies being provided. This will effect your cash flow. Furthermore, if you are on a flat rate scheme, then the scheme will more than likely no longer be beneficial for you. If your sales are subject to the domestic reverse charge, then you would be considered as a regular repayment trader and could enrol on a monthly VAT return scheme to ease your cash flow by getting the VAT paid back to you on your expenses.

As the supplier, you will need to issue VAT invoices that clearly indicate the supplies are subject to the domestic reverse charge and that the customer is required to account for the VAT. The VAT due should be clearly stated however should not be included in the amount shown as total amount charged.

If the domestic reverse charge applies, invoices should clearly indicate the reverse charge applies using the correct terminology. HMRC suggests businesses use any of the following:

- Reverse charge: VAT Act 1994 Section 55A applies

- Reverse charge: S55A VATA 94 applies

- Reverse charge: Customer to pay the VAT to HMRC

It should be clear on the invoice that the reverse charge mechanism has been applied.

You invoice should still show all the usual information required for a VAT invoice.

The legislation stipulates that if there is a reverse charge element in a supply then the whole supply will be subject to reverse charge if the parties agree. It will also cover the provision of construction services that includes materials.

There is no minimum threshold from which the reverse charge would apply.

Please contact us on 020 8761 8000 or email ali.asilzadeh@taxfile.co.uk if you would like to discuss how the domestic reverse charge will effect your business.