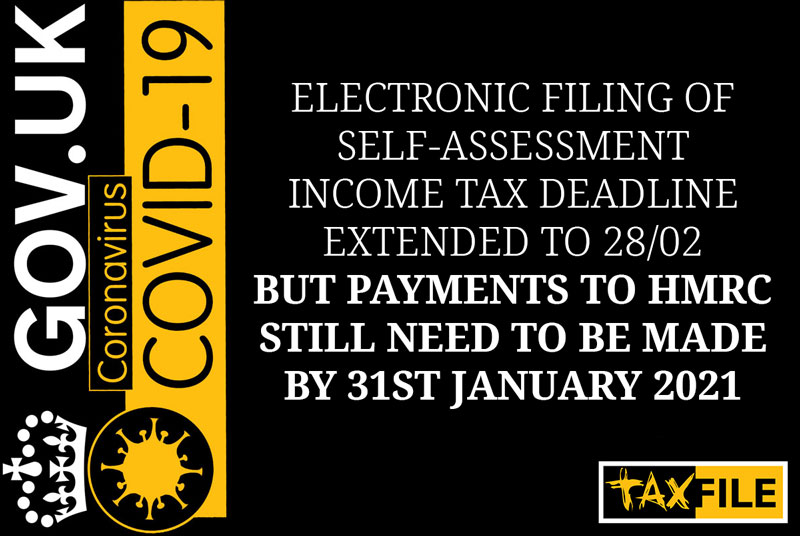

With the self-assessment tax deadline looming in the midst of a global pandemic and no announcement of an extension from the government (28 days would do), 5.4m* taxpayers (45%) still needing to submit a tax return before the 31st January and many of those are left feeling hopeless and helpless, unsure how to complete it themselves and having difficulty finding or affording an accountant who can do it on their behalf.

Some will attempt to complete the tax return online themselves but without a Government Gateway ID that task will be impossible. Obtaining the Government Gateway ID would require having their ID checked and confirmed online and without a valid UK passport and/or driving licence the task will lead to long phone calls on hold waiting for a HMRC advisor, who are currently running somewhat of a skeleton crew as a result of the pandemic (at least that’s the impression given due to the long waiting times even on the authorised agents helplines and the reduced opening hours).

Even if you do have Government Gateway ID (and password), you will need to work through HMRC’s Self-Assessment form, deciding which of the sections are relevant to you & compiling the information required for each part. Take a look at these help sheets especially useful for people with self-employed earnings (some of the business income references use the word business which can confuse as the rules and guidelines are equally applicable to sole traders working for themselves).

Also check out the HMRC’s toolkit: https://www.gov.uk/government/publications/hmrc-business-profits-toolkit.

You will need to accurately assess all your business income and more so, expenses, ensuring the correct figures are entered and submitted. Knowing what expenses you can and can’t claim can really have a negative or positive effect on the tax bill you will be presented with at the end but how do you ensure you are paying the correct amount of tax?

Looking for assistance from HMRC’s website can provide some valuable information if you know what you are looking for (see the help sheets mentioned above) but from the distance, for the everyday taxpayer, this task can be rather daunting. Finding personal help, assistance, and guidance can be difficult, especially when the people that can help those most are currently experiencing their busiest period in the industry whilst coping with the effects of COVID on their workforce.

Many may opt for the avoidance strategy until the £100 late filing penalty lands on their door and further threats of daily fines & interest kicks them into action. You will have a ground to appeal any fines or penalties if you have been affected by COVID. This will involve writing a formal letter to HMRC and providing any evidence they may request to overturn the fine.

We do recommend that however hard it maybe, it’s a good idea to put some money on your HMRC self-assessment account to settle last year’s tax if you can at least estimate it because at the end of February any tax still outstanding from the previous year which ended 05/04/20 will attract a surcharge which is almost impossible to appeal against so give it a go and work out your taxable profit and then put it in this calculator so you can guesstimate how much you need to rustle up.

If you need an injection to your cash flow even if you were eligible and claimed for the SEISS grants, we would strongly recommend you apply for the Bounce Back Loan Scheme (BBLS) if you have not done so already. This can be done via your bank provider online & in many cases they may require you to open a business bank account. You are then eligible for a maximum of 25% of your 2018/19 business turnover (a minimum of £2k and maximum amount of £50k being leant). The interest rate for this loan is 2.5% for 6-years and the government will pay the interest for the first 12-months of the loan.

Taxfile is currently working closely with local government and our director is on the board of the local business improvement district, we like to think of ourselves as the local tax office for the people of south London, we may be able to give you a little help along the way so why not give us a call for a free 20 minute confidential chat on 020 8761 8000

*figure correct on 01/01/21