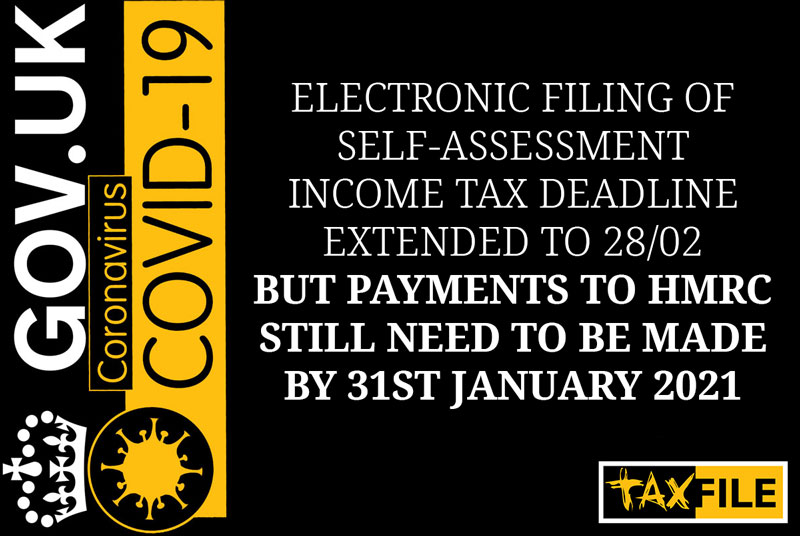

HMRC Extends the Self-Assessment Submission Deadline to 28th February BUT Payments still need to be made by 31st January

Yesterday HMRC made an 11th hour decision to give the remaining 3 million tax payers an additional 28-days to file their tax return electronically.

For most, a submission after the 31st of January would have resulted in a £100 late filing penalty. With planning already underway at HMRC on how to cope with the administrative task of appeals around COVID & late filing, HMRC has decided to only issue the penalties after 28th February, effectively offering a 1-month extension on the electronic submission of self-assessment income tax.

However, the payment date for taxes remains unchanged, so it is important to note that taxpayers are still obliged to pay any tax they still owe (including any deferred payments) by 31/01. In fact we are advising our clients to pay as much as they can into their HMRC self-assessment account and to view it as a bank account with HMRC so that, once their taxes are filed, they are not left with any unwanted surprises with interest on late payments, as any unpaid tax from 19/20 will be charged interest as of 01/02.

The extension has been welcomed and our own Director Guy Bridger had approached the Treasury requesting this extension. so even though there is a sense of relief, we are adamant that tax payers realise they need to settle their outstanding tax bill if they can, even if it is an estimate, otherwise they will face HMRC’s low rate of annual interest on late payment of taxes along with the initial surcharge of 5% of any tax unpaid for the 19/20 tax year after 28-days. So Guy’s suggestion is to pay as much tax as you can before 28th of February.

Please view your UTR as a bank account with HMRC, and any money paid into HMRC’s account with your UTR is money that will sit on your account until it needs to be used up.

So, even though your taxes can now be filed electronically by no later than 28/02, you will need to pay money into your HMRC account by 31/01. If you still need us to calculate and submit your 19/20 taxes, please come and see us or call us on 020 8761 8000. Even though we might not file them before the 31st January, you will at least know the outstanding amount owed.