New 30-Day Rules for Capital Gains on Residential Property

New rules have now come into force in relation to capital gains made on disposals of UK residential property*. Several key actions are now required if a taxable capital gain has arisen, including some that now need to be made fast:

- Taxpayers need to report the property’s disposal within 30 days of the actual disposal;

- They will need to pay the estimated Capital Gains Tax (‘CGT’) to HMRC within 30 days of the disposal.

- Those who fill in and submit a Self-Assessment tax return will also need to include details of the disposal on their return.

Who Do the New CGT Rules Apply To?

The new rules apply whether you’re an individual, joint property owner, trustee, partner in a partnership or LLP, or a personal representative.

What Counts as a Residential Property Disposal?

The new rules apply to all UK residential property that was disposed of (taken as the date of the exchange of contracts) since 6 April 2020 inclusive, where a capital gain was made that will require payment of CGT.

To fall within the rules, a UK residential property must be one that:

- is suitable for use as a dwelling, or;

- is being built or adapted for use as a dwelling.

It can be one in which the the owner has never lived or has lived for only part of the period they owned it. It can also be a rental property or a holiday home.

Where a property has been used for mixed purposes, only the capital gain that’s equivalent to Read more

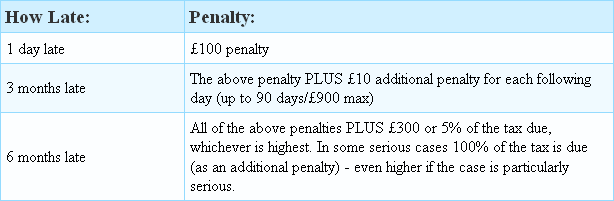

If you still haven’t filed your tax return for the financial year up to 5 April 2014 you can expect the penalties from HMRC to begin racking up daily — and potentially very significantly — starting from Friday 1 May.

If you still haven’t filed your tax return for the financial year up to 5 April 2014 you can expect the penalties from HMRC to begin racking up daily — and potentially very significantly — starting from Friday 1 May.

Where possible, Taxfile customers are urged to submit their records to Taxfile before December 1st 2014 so as to beat the price increases which will come into effect from that date. Taxfile has held its prices for several years now, and unusually long for our industry, however every so often we have to take stock and catch up with inflation and the ever-increasing costs of operating a business inside London. At time of writing, Taxfile customers still have time to submit their paperwork and records for professional tax and accountancy help – for example for tax returns – so can totally avoid the price increases this year if they act reasonably fast and get their figures and records etc. to us before December 1st. This will also avoid bottlenecks as we fast approach the busiest time in the tax year. Taxfile will also be sending out reminders to its active customer database.

Where possible, Taxfile customers are urged to submit their records to Taxfile before December 1st 2014 so as to beat the price increases which will come into effect from that date. Taxfile has held its prices for several years now, and unusually long for our industry, however every so often we have to take stock and catch up with inflation and the ever-increasing costs of operating a business inside London. At time of writing, Taxfile customers still have time to submit their paperwork and records for professional tax and accountancy help – for example for tax returns – so can totally avoid the price increases this year if they act reasonably fast and get their figures and records etc. to us before December 1st. This will also avoid bottlenecks as we fast approach the busiest time in the tax year. Taxfile will also be sending out reminders to its active customer database. HMRC have sent out warnings over a significant threat from new ‘phishing’ emails purporting to be from them. They are, in fact, scam emails which include links to replicas of the HMRC site and are designed to trick people into disclosing security-sensitive financial and personal information such as bank details, National Insurance numbers, credit card details, passwords, mother’s maiden names and so on. In the wrong hands these details could mean theft of your money or even your identity. Many people do not realise they have been scammed until it’s too late so taxpayers need to stay alert when checking emails and browsing online.

HMRC have sent out warnings over a significant threat from new ‘phishing’ emails purporting to be from them. They are, in fact, scam emails which include links to replicas of the HMRC site and are designed to trick people into disclosing security-sensitive financial and personal information such as bank details, National Insurance numbers, credit card details, passwords, mother’s maiden names and so on. In the wrong hands these details could mean theft of your money or even your identity. Many people do not realise they have been scammed until it’s too late so taxpayers need to stay alert when checking emails and browsing online.