Still Haven’t Filed Your Tax Return? Expect a Nasty Bill from HMRC!

If you still haven’t filed your tax return for the financial year up to 5 April 2014 you can expect the penalties from HMRC to begin racking up daily — and potentially very significantly — starting from Friday 1 May.

If you still haven’t filed your tax return for the financial year up to 5 April 2014 you can expect the penalties from HMRC to begin racking up daily — and potentially very significantly — starting from Friday 1 May.

If you missed the 31 January Tax Return deadline …

If you missed the 31 January 2015 deadline for tax returns, you already owe HMRC £100 in fines on top of any tax you owe. If you don’t owe any tax whatsoever, HMRC still require a tax return from you, plus that £100 in penalties.

If you still haven’t filed your return by 1 May …

From 1 May 2015 you can also expect a £10 daily penalty to kick in, on top of the £100 fine above, up to a maximum addition for the period of £900 (90 days) extra. But it gets even worse…

If you STILL haven’t filed your return by 30 July …

After the 90 day period beginning on May 1st, if you STILL haven’t filed your tax return you’ll receive a further £300 penalty (or 5% of the tax due; whichever is highest) plus a possible additional fine equivalent to 100% (or more) of the tax due, depending on how serious the case is.

Each of these individual penalties is in addition to the preceding ones.

So, to conclude, if by 30 July 2015 you STILL haven’t filed your latest tax return you will be in for a minimum penalty of an incredible £1300.00 and that’s in addition to the tax you owe. Also, Read more

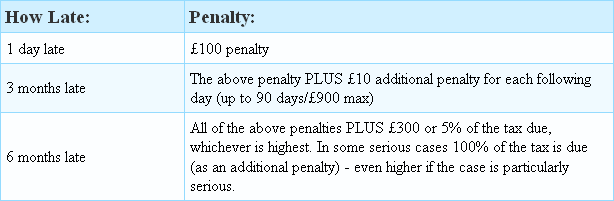

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.