Avoid Significant HMRC Penalties – file your tax return on time!

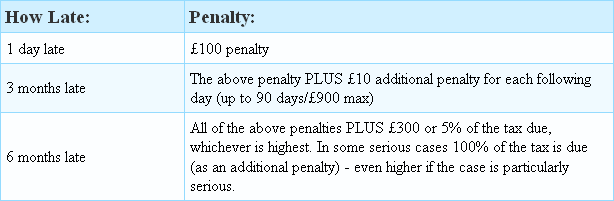

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.

So our message is simple: don’t file late, and don’t pay late! Taxfile are here to help you, of course. We know Self Assessment Tax Returns back to front and we can help you file accurately, and on time. If you’re late, we can help to sort things out quickly and so keep any HMRC penalties to a minimum.

In some specific situations there will be different deadlines to those shown above, including if HMRC has confirmed a different one in writing, but also in a few other scenarios. So it’s best to double-check with Taxfile or, better still, let Taxfile deal with your self-assessment return on your behalf.

One last thing: please don’t forget to bring in all your receipts and records when you come to see us for your return; many thanks. To make an appointment, call 0208 761 8000, email us here or book online.