As a barrister you are treated as self employed by HM Revenue and Customs.

Historically barristers computed their professional profits for tax purposes on a “cash basis.”

Fees were brought into account only when received, and expenses only when paid.

From fiscal year 1999/00, it is required that all professionals including most barristers to compute their profits on a “true and fair view.”

Barristers in their first seven years of practice are still allowed to use the cash basis.

In computing their profits for tax purposes, barristers can deduct certain expenses like:

• Travelling costs from Chambers to court;

• Off street parking;

• Library and periodical subscriptions;

• Postage, printing, photocopying and stationary;

• Professional and accountancy fees;

• Devilling fees

• Chambers’ rent;

• Legal literature;

• Professional Indemnity Insurance premiums;

• Subscriptions (Circuit, Bar Council, Bar Associations)

• Bank charges;

• Use of home as an office;

• Robing room fees;

• Law report subscriptions;

• Staff costs;

• Silk application fees;

• Clothing and cleaning.

According to HMRC, “You should allow a deduction in computing profits for the cost of replacing gowns and wigs and frock coats worn by Queen’s Counsel. You should not, however, allow a deduction for expenditure on `normal clothes’, for example, black coats and pin- stripe trousers worn by male barristers or black dresses and suits worn by female barristers (this follows the decision in Mallalieu v Drummond”

Taxfile‘s tax agents will ensure you keep the necessary records of your income and expenditure and you make the right adjustments with regards the to private use of your expenditure.

Also, our tax accountants in South London and Exeter will make sure you obtain the maximum available tax deduction when calculating your taxable profits.

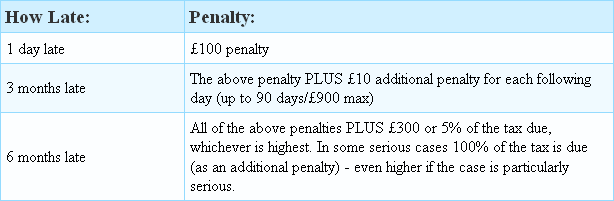

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.

Where possible, Taxfile customers are urged to submit their records to Taxfile before December 1st 2014 so as to beat the price increases which will come into effect from that date. Taxfile has held its prices for several years now, and unusually long for our industry, however every so often we have to take stock and catch up with inflation and the ever-increasing costs of operating a business inside London. At time of writing, Taxfile customers still have time to submit their paperwork and records for professional tax and accountancy help – for example for tax returns – so can totally avoid the price increases this year if they act reasonably fast and get their figures and records etc. to us before December 1st. This will also avoid bottlenecks as we fast approach the busiest time in the tax year. Taxfile will also be sending out reminders to its active customer database.

Where possible, Taxfile customers are urged to submit their records to Taxfile before December 1st 2014 so as to beat the price increases which will come into effect from that date. Taxfile has held its prices for several years now, and unusually long for our industry, however every so often we have to take stock and catch up with inflation and the ever-increasing costs of operating a business inside London. At time of writing, Taxfile customers still have time to submit their paperwork and records for professional tax and accountancy help – for example for tax returns – so can totally avoid the price increases this year if they act reasonably fast and get their figures and records etc. to us before December 1st. This will also avoid bottlenecks as we fast approach the busiest time in the tax year. Taxfile will also be sending out reminders to its active customer database.

Her Majesty’s Revenue & Customs (‘HMRC’) have now completed a 7 month pilot scheme, held across the North East of England, whereby they closed existing HMRC Enquiry Centres and instead offered those requiring extra help with tax-related issues assistance in a different, more tailored way. With the pilot scheme now complete and deemed a success, all Enquiry Centres across the UK will be closed by 30 June 2014 (just a few days away at time of writing) in favour of the new, more tailored system.

Her Majesty’s Revenue & Customs (‘HMRC’) have now completed a 7 month pilot scheme, held across the North East of England, whereby they closed existing HMRC Enquiry Centres and instead offered those requiring extra help with tax-related issues assistance in a different, more tailored way. With the pilot scheme now complete and deemed a success, all Enquiry Centres across the UK will be closed by 30 June 2014 (just a few days away at time of writing) in favour of the new, more tailored system.