Filing with Companies House – A Guide for Limited Companies

Companies House is the Government agency responsible for maintaining the public register of companies in the UK. Filing with Companies House typically refers to the submission of various documents and records, as required by the registrar of companies in the United Kingdom. In today’s guide, we’ll take a look at what types of document need to be filed, when to file them, and what happens if they’re not filed on time.

What Sort of Documents are Filed at Companies House?

Some of the most common types of filings with Companies House include the following:

Annual Accounts

Most companies are required to file annual accounts, which include a balance sheet, profit and loss account, and notes to the accounts. The filing deadline for this varies and depends on when the company was set up.

A company gets nine months from its year-end in which to file the company accounts to Companies House and such a period helps in some ways. However, it also leaves the company’s accountants with little time to prepare and the directors with very little time to pay their Corporation Tax bill. Ideally, therefore, records should be with the accountant in the month following the company’s year-end rather than in the month the deadline falls — which is so often the case.

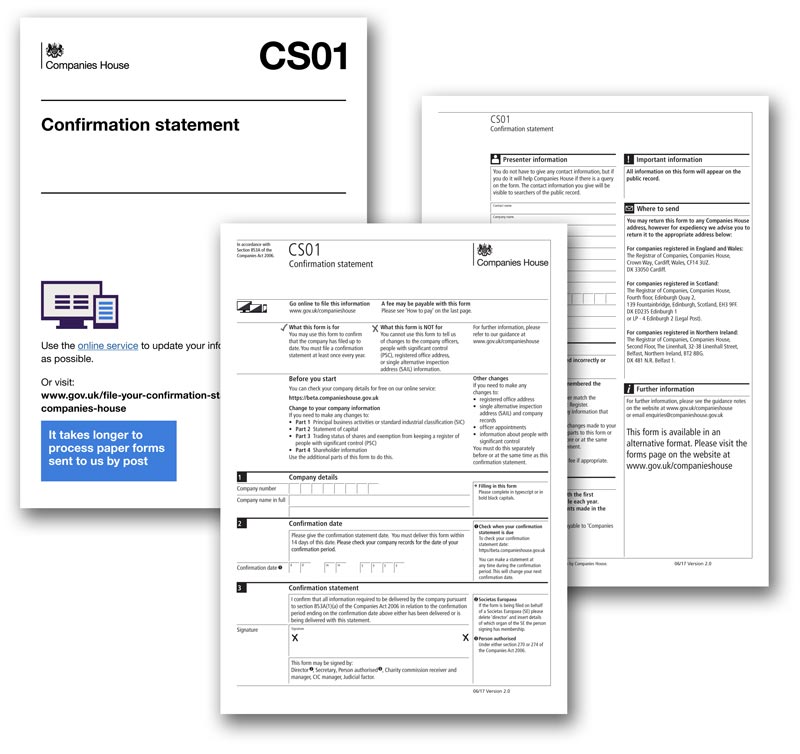

Confirmation Statement

The Confirmation Statement replaced the Annual Return in 2016. It confirms that information about the company held by Companies House is accurate and up to date. The Confirmation Statement must be filed at least once a year, even if there have been no changes to the structure of the company (e.g. changes to directors, shareholders, share capital etc.).

It is very important to update the Confirmation Statement when it is due. That’s because, if it becomes too overdue, Companies House is quick these days with a potentially severe punishment: a proposal to strike off the company.

Changes to Company Details

Any changes to the company’s details, such as changes to the registered office address, directorships, company name, or share structure, need to be filed with Companies House.

Special Resolutions and Share Allotments

Similarly, any significant changes to the company’s structure or decisions made by shareholders (such as issuing new shares or changing the company’s constitution) need to be filed with Companies House.

Incorporation Documents

When registering a new company, various documents such as the Memorandum and Articles of Association need to be filed with Companies House.

Once the company has been set up, the director of the company will receive an Authentication Code. This needs to be kept safe as it works like a PIN code and is used for filings with Companies House online.

Company Dissolution

Conversely, if a company is being dissolved (closed down), the necessary paperwork also needs to be filed with Companies House.

Filing requirements and deadlines can vary depending on the type and size of the company. Failure to file required documents accurately and on time can result in penalties and other adverse consequences for the company and its officers. It’s important, therefore, for company directors and secretaries to stay on top of their filing obligations with Companies House. By doing so, they should avoid the negative consequences associated with non-compliance with the law.

Taxfile – Accountants & Tax Advisors, South London

Professional help for all your tax issues and accountancy needs

Get in touch with our friendly tax team today for accountancy help for your limited company or small business. We’ll be happy to help!

Taxfile are accountants and tax advisors in Tulse Hill, and Dulwich (South London), as well as in Devon & Cornwall.