Online banking may save you money!

Do you have online banking? Sending us downloaded statement information straight from your online banking means we can more easily import the data into our system and check for expenses and income which might otherwise have been overlooked. It can also fill in the gaps where you are missing receipts or invoices. This simple service could therefore save both time and money! Most online banking platforms allow you to export this information, for example as a CSV file, and this format is perfect for our accounting system.

Do you have online banking? Sending us downloaded statement information straight from your online banking means we can more easily import the data into our system and check for expenses and income which might otherwise have been overlooked. It can also fill in the gaps where you are missing receipts or invoices. This simple service could therefore save both time and money! Most online banking platforms allow you to export this information, for example as a CSV file, and this format is perfect for our accounting system.

Don’t have online banking? No problem! We also have a new system where we can scan in your paper statements straight into our ‘Bankstream’ accounting platform, making analysis faster and easier.

Either way, ask us for further information or, better still, send us a sample download of a typical month’s bank data (or Read more

[UPDATED]: Calling all subbies! Claim your refund in time for Christmas AND get a 5% discount on Taxfile prices if you submit your records to us before 21st December!

[UPDATED]: Calling all subbies! Claim your refund in time for Christmas AND get a 5% discount on Taxfile prices if you submit your records to us before 21st December!

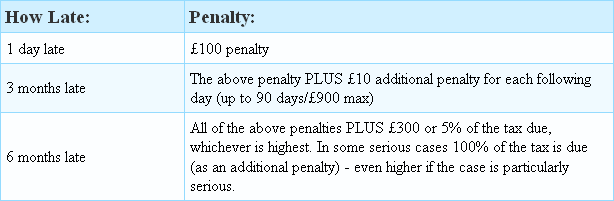

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.

Where possible, Taxfile customers are urged to submit their records to Taxfile before December 1st 2014 so as to beat the price increases which will come into effect from that date. Taxfile has held its prices for several years now, and unusually long for our industry, however every so often we have to take stock and catch up with inflation and the ever-increasing costs of operating a business inside London. At time of writing, Taxfile customers still have time to submit their paperwork and records for professional tax and accountancy help – for example for tax returns – so can totally avoid the price increases this year if they act reasonably fast and get their figures and records etc. to us before December 1st. This will also avoid bottlenecks as we fast approach the busiest time in the tax year. Taxfile will also be sending out reminders to its active customer database.

Where possible, Taxfile customers are urged to submit their records to Taxfile before December 1st 2014 so as to beat the price increases which will come into effect from that date. Taxfile has held its prices for several years now, and unusually long for our industry, however every so often we have to take stock and catch up with inflation and the ever-increasing costs of operating a business inside London. At time of writing, Taxfile customers still have time to submit their paperwork and records for professional tax and accountancy help – for example for tax returns – so can totally avoid the price increases this year if they act reasonably fast and get their figures and records etc. to us before December 1st. This will also avoid bottlenecks as we fast approach the busiest time in the tax year. Taxfile will also be sending out reminders to its active customer database. HMRC have sent out warnings over a significant threat from new ‘phishing’ emails purporting to be from them. They are, in fact, scam emails which include links to replicas of the HMRC site and are designed to trick people into disclosing security-sensitive financial and personal information such as bank details, National Insurance numbers, credit card details, passwords, mother’s maiden names and so on. In the wrong hands these details could mean theft of your money or even your identity. Many people do not realise they have been scammed until it’s too late so taxpayers need to stay alert when checking emails and browsing online.

HMRC have sent out warnings over a significant threat from new ‘phishing’ emails purporting to be from them. They are, in fact, scam emails which include links to replicas of the HMRC site and are designed to trick people into disclosing security-sensitive financial and personal information such as bank details, National Insurance numbers, credit card details, passwords, mother’s maiden names and so on. In the wrong hands these details could mean theft of your money or even your identity. Many people do not realise they have been scammed until it’s too late so taxpayers need to stay alert when checking emails and browsing online.

Her Majesty’s Revenue & Customs (‘HMRC’) have now completed a 7 month pilot scheme, held across the North East of England, whereby they closed existing HMRC Enquiry Centres and instead offered those requiring extra help with tax-related issues assistance in a different, more tailored way. With the pilot scheme now complete and deemed a success, all Enquiry Centres across the UK will be closed by 30 June 2014 (just a few days away at time of writing) in favour of the new, more tailored system.

Her Majesty’s Revenue & Customs (‘HMRC’) have now completed a 7 month pilot scheme, held across the North East of England, whereby they closed existing HMRC Enquiry Centres and instead offered those requiring extra help with tax-related issues assistance in a different, more tailored way. With the pilot scheme now complete and deemed a success, all Enquiry Centres across the UK will be closed by 30 June 2014 (just a few days away at time of writing) in favour of the new, more tailored system. Have you ever wondered how much of one’s total income is taken up in tax? And I don’t mean just Income Tax. I mean in ALL taxes paid by ordinary taxpayers throughout the course of a year. Such a figure would need to take into account National Insurance (income tax in all but name, some might say), the insidious Value Added Tax or ‘VAT’ – which on its own is a hefty 20% tax on what is often already taxed money for most ordinary taxpayers, and don’t forget to include Council Tax and finally, of course, Income Tax itself.

Have you ever wondered how much of one’s total income is taken up in tax? And I don’t mean just Income Tax. I mean in ALL taxes paid by ordinary taxpayers throughout the course of a year. Such a figure would need to take into account National Insurance (income tax in all but name, some might say), the insidious Value Added Tax or ‘VAT’ – which on its own is a hefty 20% tax on what is often already taxed money for most ordinary taxpayers, and don’t forget to include Council Tax and finally, of course, Income Tax itself. Many ordinary working taxpayers do not even know it exists, but The Taxpayers Charter is there to make sure that HMRC give you a service that is even-handed, accurate and based on mutual trust and respect. HMRC also want to make it as easy as possible for you to get things right.

Many ordinary working taxpayers do not even know it exists, but The Taxpayers Charter is there to make sure that HMRC give you a service that is even-handed, accurate and based on mutual trust and respect. HMRC also want to make it as easy as possible for you to get things right.