Missed the Tax Return Deadline?

[Updated 3 February 2020]: If you missed the deadline for submission of your tax return to HMRC (that was 12 midnight on Saturday 31 January) here’s what you can expect in terms of a fine:

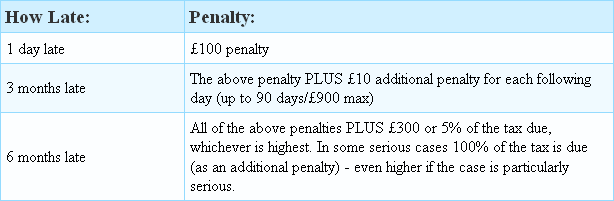

In case you didn’t realise, you still had to submit a tax return even if you did not owe any tax and the longer you leave it, the more it will cost you — as you can see in the table above. Alternatively, use this excellent estimation tool to work out your exact penalty at any given point in time. Not sure if you even need to submit a Self Assessment tax return? No problem; there’s a tool for that too (here).

Statistically speaking, women seem to send in their returns on time more often than men; 18 to 20 year olds of either sex are the very worst with around 11% of them sending in their returns late in recent years, while those over 65 seem to be statistically the most reliable of all, with only around 1½% of them having filed tax returns late. We’ll have to wait and see how it panned out this year when the figures are in.

Taxfile are here for you if you need to get your tax return sorted out whether you’re on time or not – but the earlier the better if you’re to minimise any penalty from HMRC. We are professional accountants and tax advisors, are based in South London, and will help to get your tax affairs in order with minimal fuss. We will ensure that all your figures are correct so that you pay only the right amount of tax – no more, and no less. For professional tax help contact us or book an appointment on-line.

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.