“Pay As You Go” Self-Assessment is on it’s way!

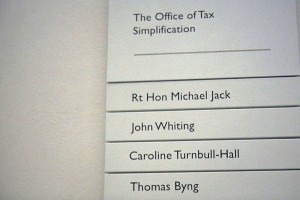

A few years ago Guy Bridger, from Taxfile, was helping to advise The Office of Tax Simplification and the then Director Michael Jack. Guy proposed that, while the bulk of the working population have their taxes calculated by their employer and therefor

A few years ago Guy Bridger, from Taxfile, was helping to advise The Office of Tax Simplification and the then Director Michael Jack. Guy proposed that, while the bulk of the working population have their taxes calculated by their employer and therefor e pay taxes in ‘real time’ with clarity, ease and convenience, the same was unfortunately not true for the UK’s small business owners and the self-employed. For those, it is too often the case that taxes are paid as much as 18 months in arrears because of limitations in the existing tax system. This time lag often means that the tax due to be paid has been spent already, simply because that old system had too large a reporting and payment window. So Guy suggested that ‘real time’ reporting and payments of tax would be significantly more convenient and beneficial to the small business owner and self-employed individual. It would enable them to keep on top of taxes and, as an added bonus, their accounts records too.

e pay taxes in ‘real time’ with clarity, ease and convenience, the same was unfortunately not true for the UK’s small business owners and the self-employed. For those, it is too often the case that taxes are paid as much as 18 months in arrears because of limitations in the existing tax system. This time lag often means that the tax due to be paid has been spent already, simply because that old system had too large a reporting and payment window. So Guy suggested that ‘real time’ reporting and payments of tax would be significantly more convenient and beneficial to the small business owner and self-employed individual. It would enable them to keep on top of taxes and, as an added bonus, their accounts records too.

The Government has now recognised this good advice. In a new system nicknamed ‘Pay As You Go Self-Assessment’, the Chancellor has announced that small businesses, landlords and self-employed workers making more than £10k in profit each year will be able to account for tax in virtually “real time”. This will be made possible via HMRC’s ongoing plan to take accounting online via the ‘digital tax accounts‘ (originally proposed in the March Budget of 2015). As we reported back then, much of the information needed by HMRC will be collected into the new digital accounts automatically. The system will reduce paper form-filling and allow people to keep much more on top of their tax payments and record-keeping as well as reducing stress and the time required to deal with HMRC. Now, with addition of the new proposals just announced, that new system represents a concise, real time reporting framework with a built-in facility to pay and manage taxes, all in one secure package.

Taxfile already uses bank-linked tax reporting software to calculate tax liabilities for their customers. Allowances are automatically offset against taxable profits because obvious expenses are tagged and tracked on bank statements which are automatically imported into Taxfile’s system. Online banking helps to make this possible, although is not essential, and handheld devices, in tandem with HMRC’s proposed new ‘digital tax accounts’ will make life even easier for Taxfile customers into the future.

If you’d like Taxfile to help automate your tax affairs, saving you time, stress and money, then call on 0208 761 8000, contact us here or book a free 20 minute consultation here and we’d be delighted to help. To date we have helped over 10,000 happy customers — so why not come aboard and give us a try!

Taxfile would like to thank filmmaker David Dunkley Gyimah who filmed the original interviews at The Office of Tax Simplification, from which the stills above were taken.