Christmas & New Year Opening at Taxfile

The Taxfile Team would like to wish all our readers and customers a very happy festive season and to pass on our very best wishes to everyone for the New Year.

Taxfile will be open as usual until Saturday* 23 December. We then close briefly for Christmas Day and Boxing Day (Monday 25 & Tuesday 26 December respectively).

We will be open again as usual from Wednesday 27th to Saturday* 30th December, then closed for the New Year’s celebrations until Tuesday 2nd January 2018 when we re-open again —from that date it’s back to our usual working hours. Here are the full details:

- Thursday 21 December: open 9am – 5pm

- Friday 22 December: open 9am – 3pm

- Saturday 23 December: open 10am to 1pm (by appointment only)

- Sunday 24 December: closed

- Monday 25 December (Christmas Day): closed

- Tuesday 26 December (Boxing Day): closed

- Wednesday 27 December: open 9am – 5pm

- Thursday 28 December: open 9am – 5pm

- Friday 29 December: open 9am – 3pm

- Saturday 30 December: open 10am -1pm (by appointment only)

- Sunday 31 December: closed

- Monday 1 January 2018 (New Year’s Day): closed for the Bank Holiday

- Tuesday 2 January onwards: open as usual Mon-Tues 9-6, Wed-Thur 9-5, Fri 9-3, Sat 9-1 (by appointment)

*Saturday morning opening is from 10am to 1pm and is for appointments only, so do book an appointment if you’d like to discuss anything with us at the weekend rather than during the normal working week.

Last few free 20 minute appointments – act fast if you’d like a free tax consultation!

If you would like a free 20 minute consultation for any tax matter, please book a date before the end of December as we pause free consultations during our busiest month of the year – in January we are swamped with tax return deadlines and have to concentrate on hitting those on behalf of our customers. Free 20 minute consultations will, of course, resume from 1st February.

You can book an appointment online here or simply call 0208 761 8000 (07766 495 871 after office hours) to arrange one with our tax professionals.

The Taxfile Team wishes you all a very happy festive season and our very best wishes for the New Year. Thank you too for your custom during 2017 — we really appreciate it. Here’s to 2018 when it arrives!

If you’d like our help with your Self-Assessment tax return, please do try to get your records and figures to us before 10th of January if you want to avoid the last minute rush and save money – there will be slightly higher charges for our help from that date (inclusive). This is to cover extra staff and overtime required during the the final part of January – our busiest time of the year – when we can deal with all the last minute returns for those who have left it until the last minute. So, save hassle, avoid the last minute bottlenecks and also save yourself some money by getting your records and figures to us well before 10th January if at all possible. We can still help thereafter, of course, but it’ll cost you a little bit more.

If you’d like our help with your Self-Assessment tax return, please do try to get your records and figures to us before 10th of January if you want to avoid the last minute rush and save money – there will be slightly higher charges for our help from that date (inclusive). This is to cover extra staff and overtime required during the the final part of January – our busiest time of the year – when we can deal with all the last minute returns for those who have left it until the last minute. So, save hassle, avoid the last minute bottlenecks and also save yourself some money by getting your records and figures to us well before 10th January if at all possible. We can still help thereafter, of course, but it’ll cost you a little bit more.

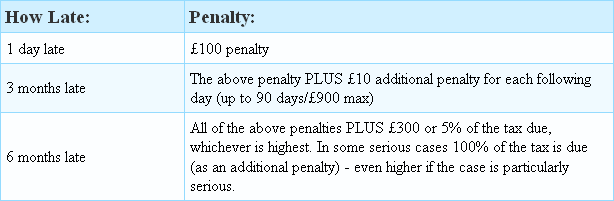

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.