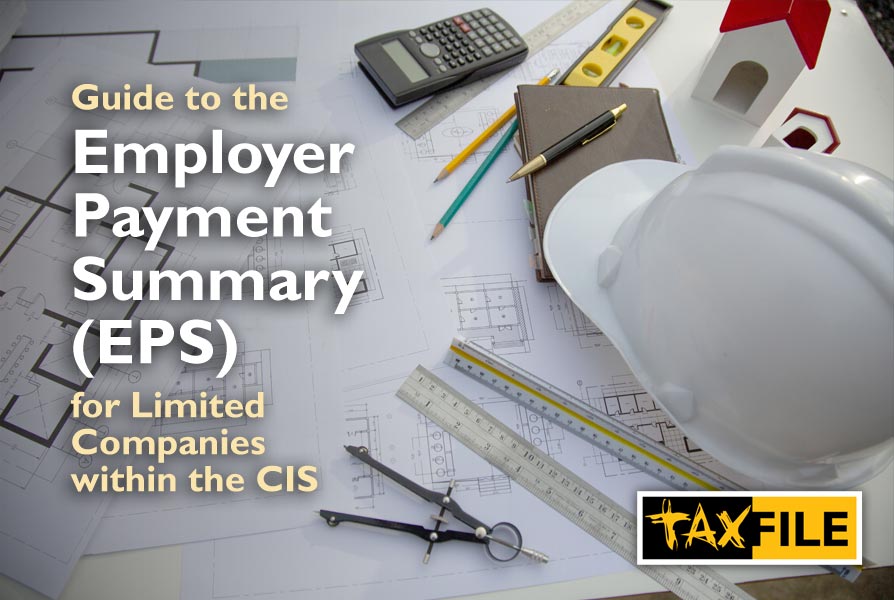

Guide to the Employer Payment Summary (EPS) – for Limited Companies within the CIS

by Daniel at Taxfile.

Understanding the Employer Payment Summary (EPS) monthly claims for limited companies within the CIS

Limited company contractors operating within the Construction Industry Scheme (CIS) have distinct payroll obligations, including the submission of their Employer Payment Summary (EPS). In today’s guide, we’ll explain what the EPS is, its purpose, and the submission rules limited companies have to follow if they work within the Construction Industry Scheme.

What is the EPS?

The Employer Payment Summary serves as a crucial mechanism for limited company contractors to report additional payments, deductions, and adjustments to HM Revenue & Customs (HMRC) alongside their regular payroll submissions. While all such employers submit a monthly EPS, limited company contractors operating under CIS have specific considerations due to their status and the nature of their work within the construction industry.

The purpose of submitting monthly EPSs for Limited Company Contractors in the CIS

The primary purpose of EPSs for limited company contractors operating within the CIS is to provide HMRC with accurate information about deductions suffered under the Construction Industry Scheme. By submitting each monthly EPS for CIS, limited company contractors also ensure compliance with CIS regulations and provide HMRC with essential data for tax calculations and entitlements.

Submitting an EPS for Limited Company Contractors working within the CIS

Limited company contractors operating within CIS are required to submit an EPS to HMRC every month, even if there are no adjustments to report. EPSs should be submitted after the end of the tax month but before the 19th of the following month, in line with HMRC guidelines.

Contractors can use HMRC’s online services or compatible payroll software to submit their monthly EPS for CIS. It’s crucial to ensure that the information provided in each EPS accurately reflects the deductions suffered under CIS.

The CIS deductions suffered sent through an EPS are promptly reflected as a credit on the PAYE account. This credit will then be utilised to set off against other liabilities, including PAYE tax, National Insurance Contributions (NIC), and subcontractor’s tax submitted through the CIS300 return.

When sending the EPS you can also claim Employment Allowance and recover statutory payments that exceed the amount of PAYE due.

Submitting EPSs late may lead to penalties imposed by HMRC, which can vary based on the extent and frequency of delays.

CIS Accountancy Help from Taxfile

At Taxfile, we can provide guidance on compliance requirements, tax calculations, and record-keeping practices.

Get in touch today for any accountancy or tax issue that needs expert help.

We can help whether you are a contractor, subcontractor, sole trader or limited company business in South London or the South West.

We are accountants in Tulse Hill, Dulwich and Devon/Cornwall.