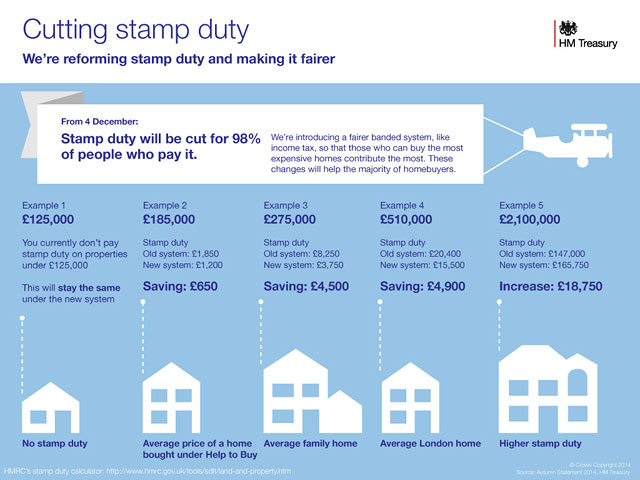

Infographic: Stamp Duty Changes: Good News for Most!

In what, for most of us, is very welcome news, the Chancellor announced a significant tidy-up of Stamp Duty in his Autumn Statement yesterday. The changes will mean that 98% of those who pay Stamp Duty will save money — and potentially a significant amount. We believe that this is a fairer system, with the richest contributing the most and, in effect, counterbalancing the savings which will be made by those buying any property for less than £937,500.

So how will this affect you?

HM Treasury have released a rather useful infographic which, with the aid of examples, gives you a good idea of the savings you will make if the property you are buying costs less than £937,500 … or for richer people the extra you’ll pay if the property price is above that threshold.

So how does it work?

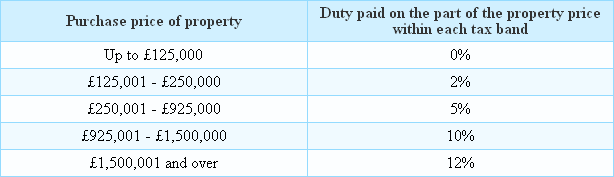

In the old Stamp Duty rules you had to pay a single Stamp Duty rate based on the entire value of the property being purchased. This meant sometimes hugely differing amounts of Stamp Duty being levied for sometimes similar property prices (depending on which side of the tax band threshold an individual house price fell). With the new tax bands, however, buyers will pay Stamp Duty at a rates applied to only the part of the property price falling within each tax band, rather like happens with income tax.

Here are the tax bands and the rates which apply:

You can also try the online Stamp Duty Land Tax calculator to get a comparison of ‘old’ and ‘new’ Stamp Duties for your particular price bracket.

The new rules start officially on 4 December 2014 but there are various rules in place, including some concessions, for those who have, for example, exchanged before 4 December but not yet completed. Further information is available in HM Treasury’s fact sheet (PDF).

At Taxfile we don’t usually get involved directly with Stamp Duty but, as we specialise in tax matters for businesses and individuals, we thought we’d pass on this new information, particularly as it will affect most people at some point – and it’s also nice to get some good news for a change! Landlords and those generating income from lettings may also find this of particular interest and, of course, if they or anyone else needs any advice on any tax matter, however large or small, we’re here to help – simply contact us here or call 0208 761 8000.