LATEST POSTS

OPENING HOURS

Monday: 9 am-6 pm

Tuesday: 9 am-6 pm

Wednesday: 9 am-5 pm

Thursday: 9 am-5 pm

Friday: 9 am-3 pm

Saturday: Closed

Sunday: Closed

Download our latest brochure:

CONTACT US

LONDON OFFICE:

Taxfile,

25 Thurlow Park Road,

Tulse Hill, London

SE21 8JP.

Tel: +44(0)20 8761 8000

Email: info@taxfile.co.uk

Taxfile: Your One-Stop Tax & Accountancy Shop

/in Accountancy, Accountants, Accounts, Advice, Auto Enrolment, Bookkeeping, Buy to let, Cab drivers, Capital gains tax, CGT, CIS, Construction Industry Scheme, CT, Disclosure, Dulwich, Estate Planning, HMRC, Income tax, Landlords, Lettings income, Limited companies, National Insurance, NI, NIC, Non-domiciled residents, Partnership, PAYE, Payroll, Self-assessment, Sole traders, Tax, Tax advice, Tax advisers, Tax enquiry, tax experts, Tax planning, Tax returns, Taxi drivers, Tulse Hill, VAT, Workplace Pensions/by MarkTaxfile has over 100 years of combined tax and accounting experience. It’s incredible to think that the key personnel have administered over 30,000 tax submissions in the past 20 years! Beginning way back in 1994 (and continuing as Guy Bridger Limited from 1997), we originally started business offering only CIS sub-contractor returns but quickly developed the service to help the self-employed, local businesses and higher rate taxpayers with their tax computations. Along the way we added tax and accounting services for taxi drivers, cab drivers, landlords and more. We also offer Capital Gains tax expertise and tax investigation help and, more recently, professional help with disclosures, written tax advice and tax planning for things like inheritance.

We have exceptional accounting experience in all key tax and accounting areas including:

Taxfile helps individuals as well as businesses. Our customers are very varied, turning over anything from £10,000 to over £1 million a year. A few are high wealth individuals who no longer need to work but still need to account for their taxes etc. Some customers have retired, others operate small businesses and some don’t even live in the UK but may have assets here. So, whatever your income, assets or situation, the message is that if you need ANY tax-related help, you’ve found the right place in Taxfile.

Taxfile also has the back-up and expertise of professional bodies on tap (so nothing is too complicated for us) and also has excellent relations with the tax authorities — we’re very well trusted by HMRC. Guy even helps in the local employment zone, which aims to improve business in the Tulse Hill and West Norwood area. So, Taxfile is very much part of the local community, particularly in South London (but expanding to other areas too — keep an eye on this blog for forthcoming information about that in the very near future).

Whatever help you need with tax and accountancy-related matters, call Taxfile on 0208 761 8000 and we’ll be delighted to help you. Alternatively,

New: Tax Advice & Planning Service

/in Accountancy, Accountants, Accounts, Advice, Bitcoin, Capital gains tax, CGT, Corporation tax, CT, Disclosure, Dividends, Dulwich, Estate Planning, Higher rate tax payers, HMRC, IHT, Income tax, Inheritance Tax, Investments, Land and property, London, Non-domiciled residents, South London, Stocks & Shares, Tax, Tax advice, Tax advisers, Tax enquiry, tax experts, Tax planning, Tulse Hill/by MarkYou can now get tax planning and tax advice from Taxfile. We have highly experienced senior accounting staff who can give you the right tax advice when you need it most — for example, when your circumstances are changing, if you’ve had trouble keeping on top of your tax commitments and need to bring things up to date, or perhaps a friend or relative simply needs a bit of reassurance with regard to their tax situation. Perhaps you have assets or income abroad as well as income in the UK and want to make sense of your tax position. Or, perhaps you have recently made a tidy profit trading crypto coins like Bitcoin and want to know where you are from the standpoint of Capital Gains or Income Tax. Maybe you need to disclose income from property rental that you have previously not told HMRC about (more about that in a later post). Those are all examples of typical situations where our new Professional Tax Advice and Tax Planning services can help you to see the wood from the trees.

A Free Telephone Consultation

In the first instance, we are inviting clients to speak for just 15 minutes with one of our resident tax planning experts. This will be in the form of a free, introductory telephone call, perhaps in February or March if it suits you. We can then see what’s needed and take it from there. We can, of course, discuss any costs with you before you commit to anything further, and there is no obligation.

Whether it’s about labour taxes, investment taxes, business taxes, disclosures to HMRC or even professional help to support you during an HMRC tax investigation, we can make sense of all the options for you and — in a fair and ethical way — help to make sure you are paying no more tax than you should do. With decades of experience in accountancy and tax planning, we know exactly what’s what when it comes to tax, so can definitely help you. Call 0208 761 8000 to arrange your free 15 minute telephone appointment with a tax expert, at a mutually convenient time. Alternatively,

Christmas & New Year Opening at Taxfile

/in 2017, 2018, Accountants, Christmas, New Year, Self-assessment, Tax advice, Tax advisers, Tax return, Tax returns, Tulse Hill/by MarkThe Taxfile Team would like to wish all our readers and customers a very happy festive season and to pass on our very best wishes to everyone for the New Year.

Taxfile will be open as usual until Saturday* 23 December. We then close briefly for Christmas Day and Boxing Day (Monday 25 & Tuesday 26 December respectively).

We will be open again as usual from Wednesday 27th to Saturday* 30th December, then closed for the New Year’s celebrations until Tuesday 2nd January 2018 when we re-open again —from that date it’s back to our usual working hours. Here are the full details:

*Saturday morning opening is from 10am to 1pm and is for appointments only, so do book an appointment if you’d like to discuss anything with us at the weekend rather than during the normal working week.

Last few free 20 minute appointments – act fast if you’d like a free tax consultation!

If you would like a free 20 minute consultation for any tax matter, please book a date before the end of December as we pause free consultations during our busiest month of the year – in January we are swamped with tax return deadlines and have to concentrate on hitting those on behalf of our customers. Free 20 minute consultations will, of course, resume from 1st February.

You can book an appointment online here or simply call 0208 761 8000 (07766 495 871 after office hours) to arrange one with our tax professionals.

The Taxfile Team wishes you all a very happy festive season and our very best wishes for the New Year. Thank you too for your custom during 2017 — we really appreciate it. Here’s to 2018 when it arrives!

Tax Return Reminder: Beat the Last Minute Rush & Save Money!

/in 2016, 2017, 2018, Accountants, HMRC, Self-assessment, Tax return, Tax returns/by MarkFor individuals, your figures, records and, where applicable, receipts are required for the financial year 6 April 2016 to 5 April 2017. (For business accounts, of course, we will also need to do accounts based on the business’s individual year end).

Either book your appointment online at taxfile.co.uk/appointments/ or call the office on 0208 761 8000 (07766 495 871 after hours). If English is not your first language we can still help, as our team speaks a variety of languages.

Please don’t leave it to the last minute – thank you.

Taxfile’s Autumn 2017 Newsletter

/in 2017, Income tax, Newsletter, Self-assessment, Tax, Tax refunds, Tax returns, Taxfile/by MarkThe Autumn 2017 edition of Taxfile’s newsletter is now out and it’s packed full of useful information, tips, recommendations and key dates in the tax and accounting calendar, including some things you need to act on right away if you want to save time and money. Here is a quick overview of the articles:

Page 1:

Page 2:

Page 3:

If you haven’t already received a copy by email, then view the newsletter online here or

The Chancellor’s Autumn Budget 2017

/in 2017, Accountancy, Autumnn Budget 2017, Budget, Landlords, Personal allowance, Property investment, Stamp Duty, Tax/by MarkThis week, Chancellor of the Exchequer Philip Hammond delivered his Autumn Budget Statement to the House of Commons. View his full 1 hour speech in the official UK Parliament video below, which also includes a response from Jeremy Corbyn, leader of the opposition: The biggest news from this budget was the Stamp Duty announcement, wherein […]

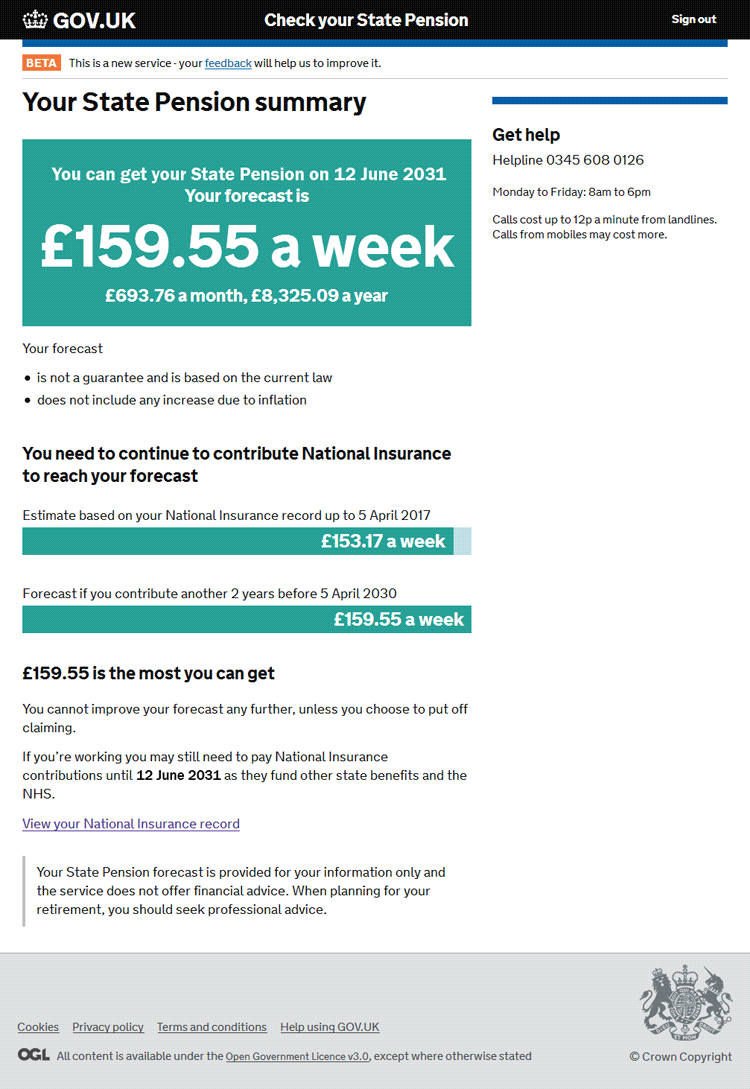

Making Tax Digital (‘MTD’), Part 1 — Your Personal Tax Account

/in Accountancy, Accountants, Making Tax Digital, MTD, Personal Tax Account, PTA/by MarkHMRC have been busy, behind the scenes, shaking things up with regard to the personal data they hold on UK taxpayers. They’ve been pulling in – rather successfully – personal data from various different government departments and bringing all that data into one central place for both them and us to see, whenever the need arises. This is all part of their longer-term plan for Making Tax Digital or ‘MTD’ as it’s known in the tax and accounting world. So, with that in mind, this is the first in a series of posts that introduces MTD and a crucial part of that; Personal Tax Accounts (PTAs). In this series of articles we’ll discuss what MTD will mean for most of us, we’ll look at the kinds of data that will be stored, see how it’ll affect us and, lastly, see if there is anything that we’ll need to do.

Personal Tax Accounts (PTAs)

For those not yet ready to take the plunge, we’ve taken a look for you, as you’ll see. And, so far, we are quite impressed.

First, though, perhaps you’d like to sign up to view your PTA account for the first time. If you do this you can perhaps follow along with our notes and see how similar records in your PTA are to those in our demonstration account. For example, we found the National Insurance Record and resulting State Pension Forecast of particular interest, but that’s just indicative of many different areas available in the new PTAs. Before starting, though, take a look at our quick word about security* because it’s important to keep your personal details safe and out of harm’s way.

Pension Forecast of particular interest, but that’s just indicative of many different areas available in the new PTAs. Before starting, though, take a look at our quick word about security* because it’s important to keep your personal details safe and out of harm’s way.

Anyway, if and when you’d like to take a look at your own PTA, head off to this page which will give you various options depending on whether you already have a Government Gateway account (to clarify, you will need a Government Gateway account before you can gain access to your PTA). If you’ve used HMRC online services before, you’ll already have a Government Gateway account. If not, follow the instructions on that page in order to set one up for the first time. To do that, you’ll need your National Insurance (NI) number and proof of identity which can include your bank account details, a P60, your 3 most recent payslips or your passport number and expiry date. It takes about 15 minutes to set up if you have these to hand.

So, assuming you now have your Government Gateway account access credentials sorted out, you can sign into your Personal Tax Account (PTA) here using your User ID and password.

Welcome to your Personal Tax Account (PTA)

As you can see, it contains several sections. From your Personal Tax Account, you can:

You can also:

Need help with your 2016-17 tax return?

/in 2016, 2017, 2018, Accountants, HMRC, Self-assessment, Tax returns/by MarkAct fast to save money!

[Updated 21 December 2017] Do you need Taxfile to sort out and file your tax return? We’d be very happy to help and do well over 1000 Self Assessment tax returns for customers every year.

However you need, please, to start giving us your paperwork ideally during December or, at a push, up to the 10th January 2018 absolute latest if you are to avoid the price increases that may come into effect thereafter. (Price increases are sometimes necessary during the busiest accounting months of the year in order to cover the extra staff needed, overtime for long hours, evening and weekend work, particularly to work on returns for those who have left it until the last minute. After 10th January, the accounting world goes mad as everyone tries to hit the January tax return deadline all at the same time — we’ll have something like 400 last-minute tax returns to do in one crazy month). So the message is:

Avoid both the bottlenecks — and a likely price increase from 10th January 2018 — by coming to see us for your tax return as soon as possible. You can book your appointment online at taxfile.co.uk/appointments/ or call the office on 0208 761 8000 (07766 495 871 after hours). If English is not your first language we can still help, as our team speaks a variety of languages.

Please don’t leave it to the last minute – thank you.

We’ll require your records, figures and receipts for the financial year 6 April 2016 to 5 April 2017.

VAT Clampdown for UK Sales on eBay & Amazon

/in 2017, Accountancy, HMRC, Online Selling, VAT/by MarkAccording to a website1 run by a campaigning group of UK eBay and Amazon business sellers, HMRC and UK traders lost out on £27 billion in sales revenue and taxes from such online marketplaces over the last three years alone. The group has campaigned for some time against over-leniency by HMRC towards overseas traders, particularly from China, who have not been charging VAT on products, despite those products being located (often via UK fulfilment houses) and supplied within the UK. Moreover, the overseas sellers’ volumes are also often well over the threshold for registering for VAT if selling from inside the UK, yet many have continued to flout the law and seem to have been getting away with it for a considerable time. That hurts both HMRC in terms of lost VAT and tax revenue, as well as making it difficult for compliant UK sellers to compete against competitor prices that seem ‘too good to be true’.

Levelling the Playing Field

However, following new changes that came into effect on 1st August, that is now starting to change. While it’s not yet a perfect system to fight VAT fraud in online marketplaces and level the playing field for legitimate UK businesses, it is at least a start. Genuine private sellers using the platforms will, though, see a small increase to their costs in the form of VAT now being levied on eBay and Amazon fees, but hopefully it’s a small price to pay to make for a more fair, and legal, system overall.

VAT Changes Starting This Month

As part of the March 2016 Finance Bill delivered by then Chancellor George Osborne, UK individuals selling on eBay will begin paying VAT on eBay charges, starting on the 1st of August (2017). The VAT rate will be the standard 20% rate and will be automatically charged on eBay fees to UK sellers who have not registered as business sellers with the company. It may at first seem odd to target non-businesses, but actually this is a way to force the likes of Amazon and eBay to put pressure on those who have not registered with them as businesses when, in many cases, they should have. Such online marketplaces will also potentially become liable for the outstanding VAT on products actually sold if they do not take measures to counter (or remove) non-compliant overseas sellers.

Those businesses operating within the UK will need to properly register as business sellers, in which case they will generally also need to account for VAT as a business if their taxable turnover is above the VAT threshold of £85,000 (or £70,000 if ‘distance selling’ into the UK) over the course of a year.

UK eBay sellers, and overseas sellers supplying/fulfilling orders completely within the UK, will now

*Last Few Saturday Appointments* for Claiming CIS Tax Refunds!

/in 2016, 2017, CIS, Construction Industry Scheme, Contractor, Subcontractor, Tax refunds, Tax return, Tax returns, Tulse Hill/by MarkIf you still haven’t claimed your CIS tax refund or submitted the tax return, Taxfile can help! However, there are only a few remaining Saturday appointments left for those wishing to see us at the weekend. So, call 0208 761 8000 or book your free appointment in Tulse Hill here without delay.

Your figures and records are required for the period 6 April 2016 to 5 April 2017, including CIS statements and receipts etc. Learn more about what documents you need to supply and how we can help you apply for your refund and submit your CIS tax return for you, here. Or, alternatively,