Taxfile’s Autumn Newsletter 2016

Hot off the press is our brand new Autumn newsletter for 2016. If you haven’t yet seen it, take a look because it’s jam-packed full of useful information that’ll help you keep your tax affairs and accounts in order, save you money and keep you up to speed on tax matters. Here’s a quick flavour of what’s included (or click the thumbnail image to view or download the newsletter):

Hot off the press is our brand new Autumn newsletter for 2016. If you haven’t yet seen it, take a look because it’s jam-packed full of useful information that’ll help you keep your tax affairs and accounts in order, save you money and keep you up to speed on tax matters. Here’s a quick flavour of what’s included (or click the thumbnail image to view or download the newsletter):

- Act fast to save money on your 2015-16 tax return – see the newsletter’s first article.

- Sub-contractors working in the construction industry are invited to claim their CIS tax refunds through Taxfile, so they have their refund in time for Christmas!

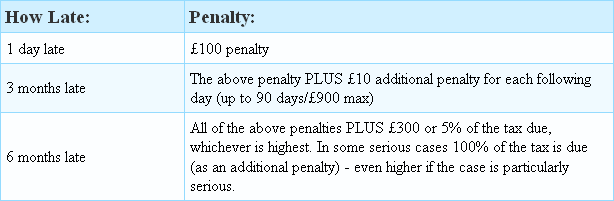

- Help if you’re late with any previous years’ tax returns and tax payments — and how you already owe HMRC at least £1300 if you haven’t filed your 2014/15 tax return or paid tax for that year.

- Try the UK’s Number 1 cloud-based accounts package FREE, for a month. No credit card required – cancel at any time – full details are included in the newsletter. [UPDATE: Please note that this offer has now expired].

- Help if your tax affairs are in a mess — are you late filing returns or paying tax? Are you worried about HMRC penalties? Are you a foreign worker, working in the UK, and need to get your tax records up to date following the Brexit decision? We’re here to help!

- Taxfile are Finalists in the ‘Independent Firm of the Year, Greater London’ category of the British Accountancy Awards 2016.

- Free tax enquiry Fee Protection Insurance for Taxfile customers who file their tax returns by the statutory deadline through Taxfile.

- How online banking may save you time and money.

- Introduce a new client to Taxfile and save 10% on our fees!

- Saturday opening at Taxfile (Tulse Hill office) throughout November and December.

- Help with all your tax and accounting needs – check out our list of all the things we can help you with — now including auto enrolment!

- And a ‘thank you’ to all Taxfile customers … Read more

[UPDATE: Please note that this offer has now expired]. Get Sage One Cashbook

[UPDATE: Please note that this offer has now expired]. Get Sage One Cashbook  If you are happy with our service we’d love to hear more about your experience with Taxfile as we are putting together a page of customer testimonials on our website(s). They need only be short if you haven’t got much time, but longer comments are fine too! As a thank you, you’ll receive a £10 off voucher which you can offset against your next Taxfile bill. Please submit your testimonial

If you are happy with our service we’d love to hear more about your experience with Taxfile as we are putting together a page of customer testimonials on our website(s). They need only be short if you haven’t got much time, but longer comments are fine too! As a thank you, you’ll receive a £10 off voucher which you can offset against your next Taxfile bill. Please submit your testimonial  Do you have online banking? Sending us downloaded statement information straight from your online banking means we can more easily import the data into our system and check for expenses and income which might otherwise have been overlooked. It can also fill in the gaps where you are missing receipts or invoices. This simple service could therefore save both time and money! Most online banking platforms allow you to export this information, for example as a CSV file, and this format is perfect for our accounting system.

Do you have online banking? Sending us downloaded statement information straight from your online banking means we can more easily import the data into our system and check for expenses and income which might otherwise have been overlooked. It can also fill in the gaps where you are missing receipts or invoices. This simple service could therefore save both time and money! Most online banking platforms allow you to export this information, for example as a CSV file, and this format is perfect for our accounting system. Where possible, Taxfile customers are urged to submit their records to Taxfile before December 1st 2014 so as to beat the price increases which will come into effect from that date. Taxfile has held its prices for several years now, and unusually long for our industry, however every so often we have to take stock and catch up with inflation and the ever-increasing costs of operating a business inside London. At time of writing, Taxfile customers still have time to submit their paperwork and records for professional tax and accountancy help – for example for tax returns – so can totally avoid the price increases this year if they act reasonably fast and get their figures and records etc. to us before December 1st. This will also avoid bottlenecks as we fast approach the busiest time in the tax year. Taxfile will also be sending out reminders to its active customer database.

Where possible, Taxfile customers are urged to submit their records to Taxfile before December 1st 2014 so as to beat the price increases which will come into effect from that date. Taxfile has held its prices for several years now, and unusually long for our industry, however every so often we have to take stock and catch up with inflation and the ever-increasing costs of operating a business inside London. At time of writing, Taxfile customers still have time to submit their paperwork and records for professional tax and accountancy help – for example for tax returns – so can totally avoid the price increases this year if they act reasonably fast and get their figures and records etc. to us before December 1st. This will also avoid bottlenecks as we fast approach the busiest time in the tax year. Taxfile will also be sending out reminders to its active customer database. Back in January

Back in January Part of the Chancellor’s recent Budget included plans to recover tax owed to the Treasury direct from the debtor’s bank account — all done directly and without a Court Order being necessary. This has been criticised widely but HMRC says that only 17,000 people in the UK per year would fall into this potential scenario and that it would only occur for those owing more than £1,000 in unpaid tax or tax credits owed. Moreover they say that they would only target long-standing tax debts from those who had received a minimum of 4 payment demands and whose bank and savings accounts combined had a minimum total balance of £5,000 or more remaining after any tax bad been directly seized. Also the debtor involved will have been issued with a final warning period of 14 days, during which the funds concerned would be frozen, before any tax was directly withdrawn.

Part of the Chancellor’s recent Budget included plans to recover tax owed to the Treasury direct from the debtor’s bank account — all done directly and without a Court Order being necessary. This has been criticised widely but HMRC says that only 17,000 people in the UK per year would fall into this potential scenario and that it would only occur for those owing more than £1,000 in unpaid tax or tax credits owed. Moreover they say that they would only target long-standing tax debts from those who had received a minimum of 4 payment demands and whose bank and savings accounts combined had a minimum total balance of £5,000 or more remaining after any tax bad been directly seized. Also the debtor involved will have been issued with a final warning period of 14 days, during which the funds concerned would be frozen, before any tax was directly withdrawn.