Guy Tells No. 10 to Extend Self-Assessment Deadline

[THERE IS BREAKING NEWS ABOUT THIS POST – CLICK HERE FOR MORE DETAILS]

Guy Bridger, Taxfile’s founder, has personally delivered a post card to Boris Johnson. He recently slipped it under the door of Number 10 Downing Street (there is no letterbox!).

The Issue with the Tax Return Deadline – & Guy’s Suggested Solution

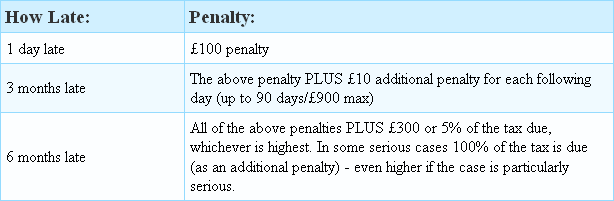

In his communication to Boris, Guy suggested that the tax return filing deadline should be permanently extended, for example to the end of February, instead of 31 January as it is currently. In his proposed scenario, people would have longer to file their tax return. As well as taking the pressure off over Christmas, New Year and during January, this later deadline would also mean less likelihood of receiving a surcharge on the possible tax debt they owed for the last tax year’s calculation. Taking this a step further and with the help of video journalist David Gyimah, Guy has also been making a documentary about the tax return filing deadline and the immense pressure it puts people under during Christmas and the New Year — and especially during the entire month of January.

In contrast, limited company businesses currently have 9 months in which to file their accounts to Companies House and at the same time pay their taxes. Interestingly, they have 12 months to file their Corporation Tax return.

Guy & Taxfile

Guy has worked in South London for 25 years, dealing with members of the public and their tax responsibilities. At Taxfile, he has long-serving, thoughtful staff on hand six, sometimes seven, days a week every January. This is a measure of just how much work the current tax return deadline causes during this key accounting month every year. Taxfile makes it their task to remind — even nag — every customer about the deadline, as most of them will have to submit a Self-Assessment tax return by 31 January.

Consulting with the Office of Tax Simplification

Guy Bridger’s last visit to the Treasury was when he worked with The Office of Tax Simplification, resulting in the recognition that people actually prepare their self-employed accounts on a cash basis.

When Guy worked with John Whiting there, the other theme he was interested in was the idea that people who were sole traders perhaps didn’t need to form a limited company. This was because, in agreement with John and many members of the consultation body, it was our view that Read more