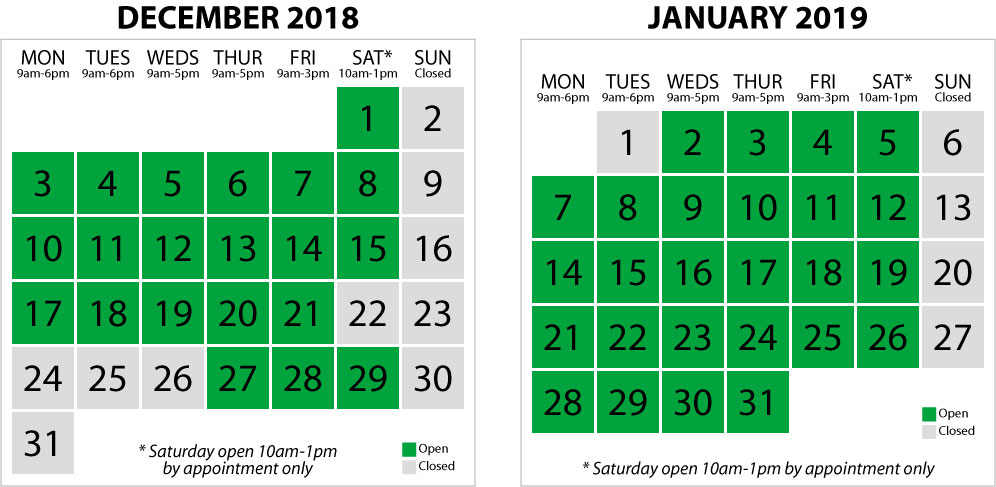

Christmas & New Year Opening Times at Taxfile

Please take a look at the calendar above and note our opening times over Christmas and New Year. As you can see, we’re closed on several days over the festive period. This is particularly important for those who need to come to see us for help with time-sensitive accounting and tax-related services in the run-up to January 31st.

Need Help Filing Your Tax Return?

Make an Appointment NOW!

In particular, we urge anyone who needs to file a 2017/18 Self-Assessment tax return to come and see us well before Christmas. By doing so, you’ll avoid the last minute stampede — way too many people leave it until January, which is the busiest time in the tax and accounting calendar. While the HMRC deadline for tax returns is the end of January, you run the risk of being caught up in the bottleneck if you leave things later than December. Taxfile files tax returns for thousands of customers during November, December and January, so we’re incredibly busy at this time of year — particularly January, which is frenetic! So, those leaving it until the last minute not only run the risk of being charged more to cover the long hours and overtime that we need to work during January, but they also risk receiving a fine from HMRC if they miss the deadline completely because they left things so late.

So the message is: please book an appointment with us now, ideally for a date before Christmas.

For Self-Assessment tax returns, records for the period 6th April 2017 to 5th April 2018 are required. For business accounts, we will also need to do accounts based upon the business’s individual year end.

Open for Saturday Appointments

We are happy to see people on Saturdays at this busy time of year (with the exception of the festive closures of course – see the calendar above). Saturday morning appointments should be more convenient for those who work on weekdays. As you can see on the calendar, we’re open from 10am to 1pm for most Saturdays in December and January but only for those with a pre-agreed appointment.

To book an appointment, please call 0208 761 8000 or book an appointment online here. Many thanks.