STILL haven’t filed your tax return? You owe £410 in fines & counting!

If you STILL haven’t filed your tax return despite the end of May being almost upon us, you’ll owe £410 in HMRC penalties by the end of this week. Continue to throw money down the drain at the rate of £10 extra per day thereafter if you still don’t submit your return.

As we explained in our last post, missing the original January 31 deadline meant an automatic HMRC penalty of £100 (on top of tax owed, of course) at that time.

But, with the additional penalty of £10 per extra day extra having been piling up since 1st May, it means you’ll need to add £310 to the original £100 penalty by the end of this week. Carry on like this for yet another month and by the end of June you’ll owe a whopping £710. It doesn’t end there — by the end of July it’ll be worse still as there is an additional £300 penalty levied by HMRC. Yes, that’s on top of the daily £10 fine and the original £100 penalty, meaning that the total penalty will then be £1300 as a bare minimum (it can be worse still if HMRC deem your case to be particularly serious). All this simply because your tax return is late.

All these penalties are in addition to the actual tax you owe!

Don’t forget … even if you owe no tax, you still need to submit your tax return so aren’t immune to the penalties. Take another look at the full post for more detail or, better still, contact us here at Taxfile urgently if you’d like our professional help in filing your tax return on your behalf — and minimising the penalties you’ll need to pay to HMRC. Call 0208 761 8000, click here to contact us or book an appointment with one of our tax advisors here and we’d be delighted to help. We are based in Tulse Hill, South London.

If you still haven’t filed your tax return for the financial year up to 5 April 2014 you can expect the penalties from HMRC to begin racking up daily — and potentially very significantly — starting from Friday 1 May.

If you still haven’t filed your tax return for the financial year up to 5 April 2014 you can expect the penalties from HMRC to begin racking up daily — and potentially very significantly — starting from Friday 1 May.

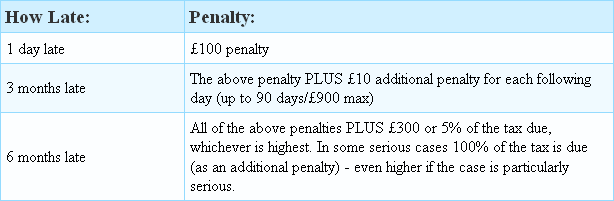

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.

Where possible, Taxfile customers are urged to submit their records to Taxfile before December 1st 2014 so as to beat the price increases which will come into effect from that date. Taxfile has held its prices for several years now, and unusually long for our industry, however every so often we have to take stock and catch up with inflation and the ever-increasing costs of operating a business inside London. At time of writing, Taxfile customers still have time to submit their paperwork and records for professional tax and accountancy help – for example for tax returns – so can totally avoid the price increases this year if they act reasonably fast and get their figures and records etc. to us before December 1st. This will also avoid bottlenecks as we fast approach the busiest time in the tax year. Taxfile will also be sending out reminders to its active customer database.

Where possible, Taxfile customers are urged to submit their records to Taxfile before December 1st 2014 so as to beat the price increases which will come into effect from that date. Taxfile has held its prices for several years now, and unusually long for our industry, however every so often we have to take stock and catch up with inflation and the ever-increasing costs of operating a business inside London. At time of writing, Taxfile customers still have time to submit their paperwork and records for professional tax and accountancy help – for example for tax returns – so can totally avoid the price increases this year if they act reasonably fast and get their figures and records etc. to us before December 1st. This will also avoid bottlenecks as we fast approach the busiest time in the tax year. Taxfile will also be sending out reminders to its active customer database. HMRC have sent out warnings over a significant threat from new ‘phishing’ emails purporting to be from them. They are, in fact, scam emails which include links to replicas of the HMRC site and are designed to trick people into disclosing security-sensitive financial and personal information such as bank details, National Insurance numbers, credit card details, passwords, mother’s maiden names and so on. In the wrong hands these details could mean theft of your money or even your identity. Many people do not realise they have been scammed until it’s too late so taxpayers need to stay alert when checking emails and browsing online.

HMRC have sent out warnings over a significant threat from new ‘phishing’ emails purporting to be from them. They are, in fact, scam emails which include links to replicas of the HMRC site and are designed to trick people into disclosing security-sensitive financial and personal information such as bank details, National Insurance numbers, credit card details, passwords, mother’s maiden names and so on. In the wrong hands these details could mean theft of your money or even your identity. Many people do not realise they have been scammed until it’s too late so taxpayers need to stay alert when checking emails and browsing online.