New Taxfile Brochure – Download Here

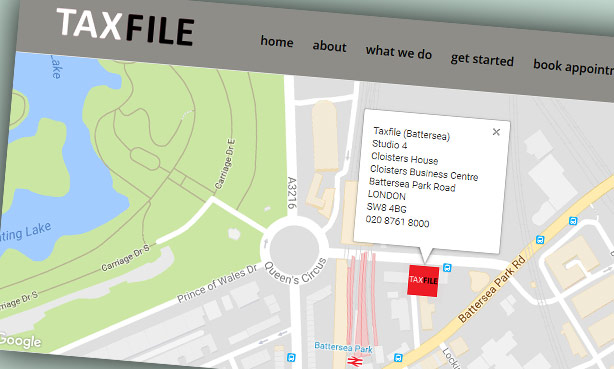

The new Taxfile brochure is out and you can download it here. Even if you’re an existing client, it’s worth taking a look in case we can help you in ways you weren’t aware of. We can help anyone e.g. the self-employed, directors of limited companies, partners in partnerships, sole traders, retired people, landlords, taxi and cab drivers, construction workers and just about anyone.

The new brochure covers:

- Self-assessment income tax returns;

- Services for SMBs;

- Accounts work for limited companies;

- Bookkeeping and bank reconciliation;

- Payroll & PAYE tax and National Insurance, company pensions and more;

- VAT help, including for VAT schemes, registration and VAT returns;

- Company pensions (auto-enrolment etc.);

- Corporation Tax returns;

- Confirmation Statements;

- Making Tax Digital (MTD);

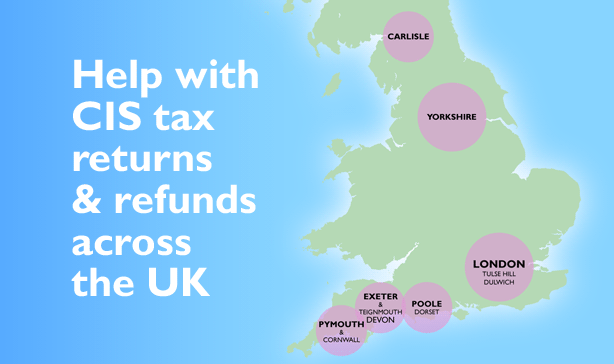

- CIS calculations and tax rebates for construction workers;

- Help with tax complications;

Dealing with HMRC on your behalf;

Dealing with HMRC on your behalf;- Joining or leaving various tax schemes;

- Capital Gains Tax (CGT) calculations and handling;

- Tax calculations relating to property income for landlords;

- Disclosures of income not previously taxed (e.g. from abroad);

- And much more.

Forward to a Friend – Free Consultation

Please feel free to forward the new Taxfile brochure to a friend who could benefit from our accountancy and tax-related services. We offer a free 20-minute consultation for new clients, without obligation.

We are open 6 days a week during February including Saturday mornings (by appointment) and later opening (until 6pm) on Mondays and Tuesdays.

Welcome to Taxfile’s Autumn Newsletter for 2021. One of our biggest yet, it includes useful tax- and accountancy-related news that you need to be aware of, ways to save time or money – and much more. Take a look!

Welcome to Taxfile’s Autumn Newsletter for 2021. One of our biggest yet, it includes useful tax- and accountancy-related news that you need to be aware of, ways to save time or money – and much more. Take a look! You’ll find QR codes throughout the newsletter. These are a quick and easy way to access further information about the topic. Assuming you are viewing the newsletter on a desktop device or a printed* version, simply point your mobile camera phone at a QR code and then open the link that pops up. Your mobile’s browser will then take you straight to the information page. Alternatively, we supply simple link URLs to simply tap in.

You’ll find QR codes throughout the newsletter. These are a quick and easy way to access further information about the topic. Assuming you are viewing the newsletter on a desktop device or a printed* version, simply point your mobile camera phone at a QR code and then open the link that pops up. Your mobile’s browser will then take you straight to the information page. Alternatively, we supply simple link URLs to simply tap in.

[Updated]: It’s common knowledge that most of Taxfile’s South London staff are multi-lingual but can you guess which staff member speaks no less than four languages fluently (Russian, Pashto, Dari and English) and which staff member is into both metal music and Irish dancing? And who should you ask for if you need payroll services? And who

[Updated]: It’s common knowledge that most of Taxfile’s South London staff are multi-lingual but can you guess which staff member speaks no less than four languages fluently (Russian, Pashto, Dari and English) and which staff member is into both metal music and Irish dancing? And who should you ask for if you need payroll services? And who