HMRC have been busy, behind the scenes, shaking things up with regard to the personal data they hold on UK taxpayers. They’ve been pulling in – rather successfully – personal data from various different government departments and bringing all that data into one central place for both them and us to see, whenever the need arises. This is all part of their longer-term plan for Making Tax Digital or ‘MTD’ as it’s known in the tax and accounting world. So, with that in mind, this is the first in a series of posts that introduces MTD and a crucial part of that; Personal Tax Accounts (PTAs). In this series of articles we’ll discuss what MTD will mean for most of us, we’ll look at the kinds of data that will be stored, see how it’ll affect us and, lastly, see if there is anything that we’ll need to do.

Personal Tax Accounts (PTAs)

One of the core elements of MTD is the Personal Tax Account (PTA). In years to come, each UK individual is likely to become very used to logging into their Personal Tax Account on the HMRC website. In fact, these already exist and most, if not all, UK taxpayers can already access them if they want to. When accessed, it’s quite interesting to see the huge amount of data already accessible via your own PTA if you care to take a look. You may be surprised just how much data they contain for you.

One of the core elements of MTD is the Personal Tax Account (PTA). In years to come, each UK individual is likely to become very used to logging into their Personal Tax Account on the HMRC website. In fact, these already exist and most, if not all, UK taxpayers can already access them if they want to. When accessed, it’s quite interesting to see the huge amount of data already accessible via your own PTA if you care to take a look. You may be surprised just how much data they contain for you.

For those not yet ready to take the plunge, we’ve taken a look for you, as you’ll see. And, so far, we are quite impressed.

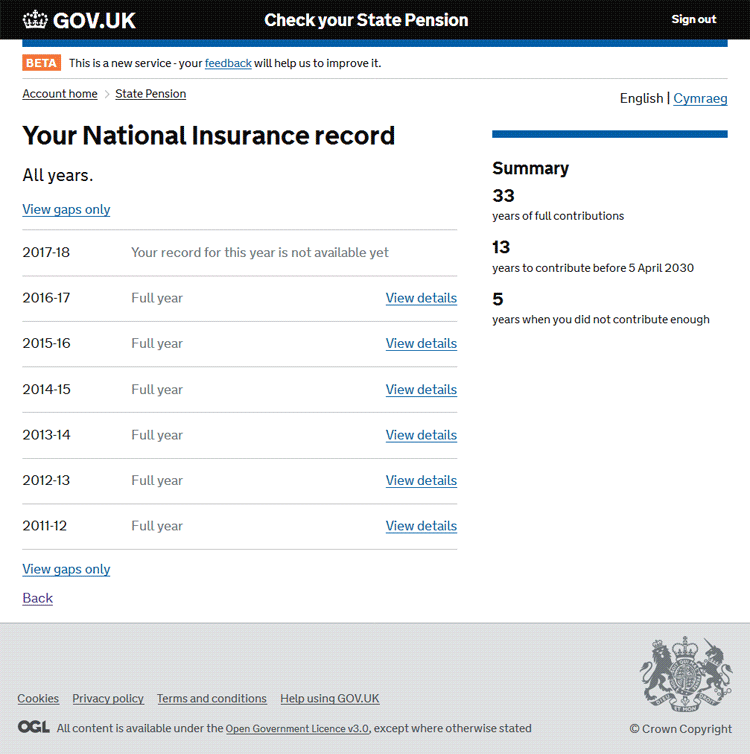

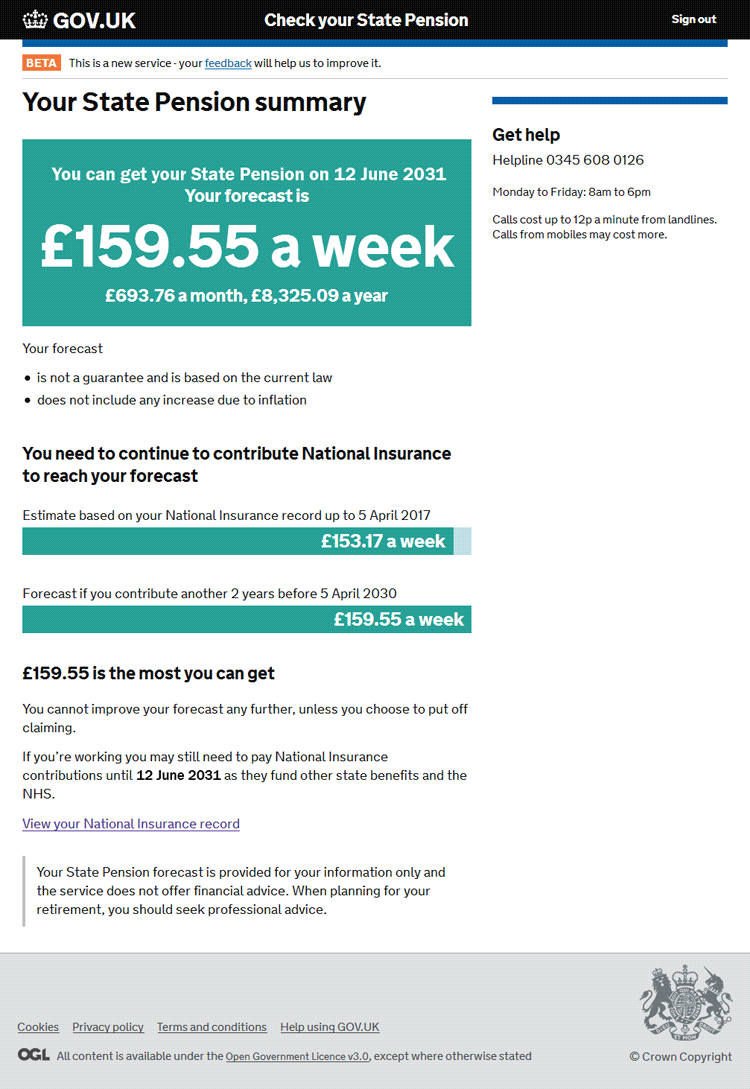

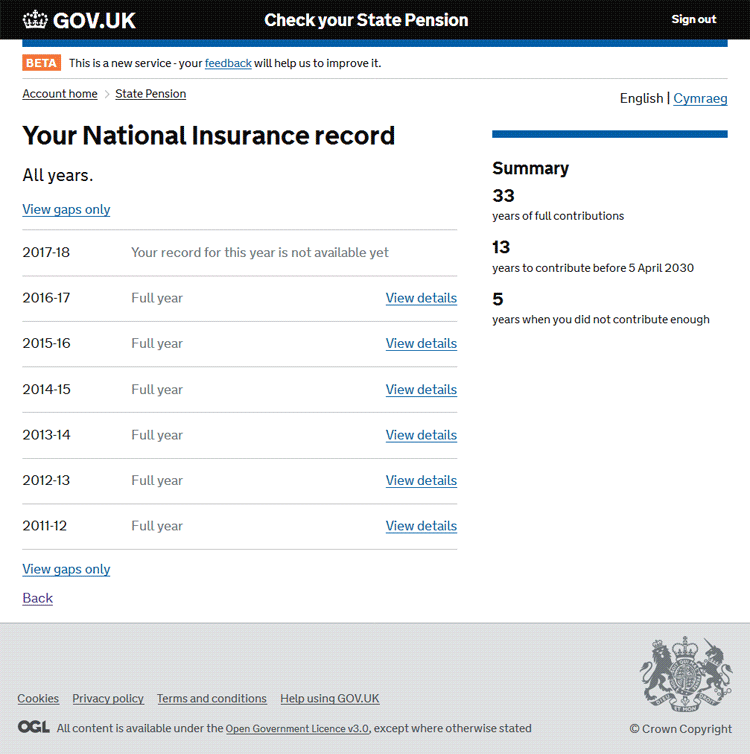

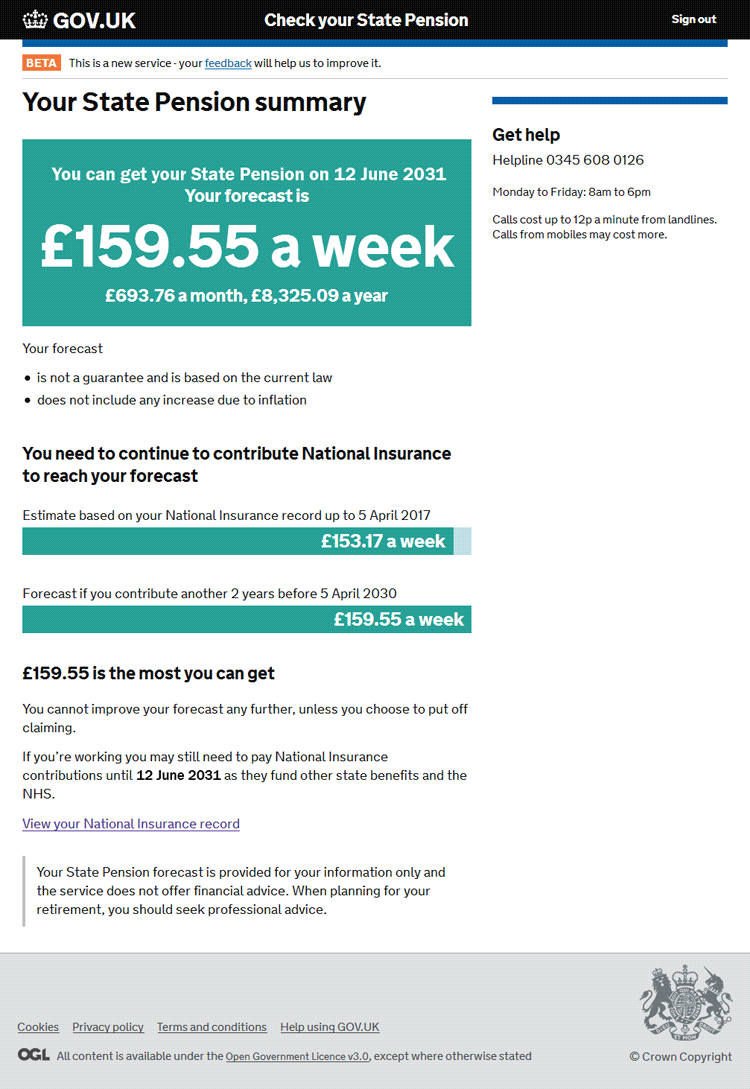

First, though, perhaps you’d like to sign up to view your PTA account for the first time. If you do this you can perhaps follow along with our notes and see how similar records in your PTA are to those in our demonstration account. For example, we found the National Insurance Record and resulting State  Pension Forecast of particular interest, but that’s just indicative of many different areas available in the new PTAs. Before starting, though, take a look at our quick word about security* because it’s important to keep your personal details safe and out of harm’s way.

Pension Forecast of particular interest, but that’s just indicative of many different areas available in the new PTAs. Before starting, though, take a look at our quick word about security* because it’s important to keep your personal details safe and out of harm’s way.

Anyway, if and when you’d like to take a look at your own PTA, head off to this page which will give you various options depending on whether you already have a Government Gateway account (to clarify, you will need a Government Gateway account before you can gain access to your PTA). If you’ve used HMRC online services before, you’ll already have a Government Gateway account. If not, follow the instructions on that page in order to set one up for the first time. To do that, you’ll need your National Insurance (NI) number and proof of identity which can include your bank account details, a P60, your 3 most recent payslips or your passport number and expiry date. It takes about 15 minutes to set up if you have these to hand.

So, assuming you now have your Government Gateway account access credentials sorted out, you can sign into your Personal Tax Account (PTA) here using your User ID and password.

When first logging in as a new user, the HMRC system may prompt you to set up an additional level of login security. For example, setting up access codes by SMS (you’ll then be sent a code to enter into the screen when logging in, to prove you are who you say you are. You’ll be sent a new access code to your mobile phone every time you sign in. It’s rather like 2FA (2 Factor Authentication) for those who are familiar with that).

You may additionally be asked some security questions, again to protect your data from hackers. In my test I was asked for my full name, date of birth, passport number and similar information (quite a bit actually). This type of heavy duty disclosure is another reason to make sure you have read our security* pointers before disclosing anything sensitive online.

Welcome to your Personal Tax Account (PTA)

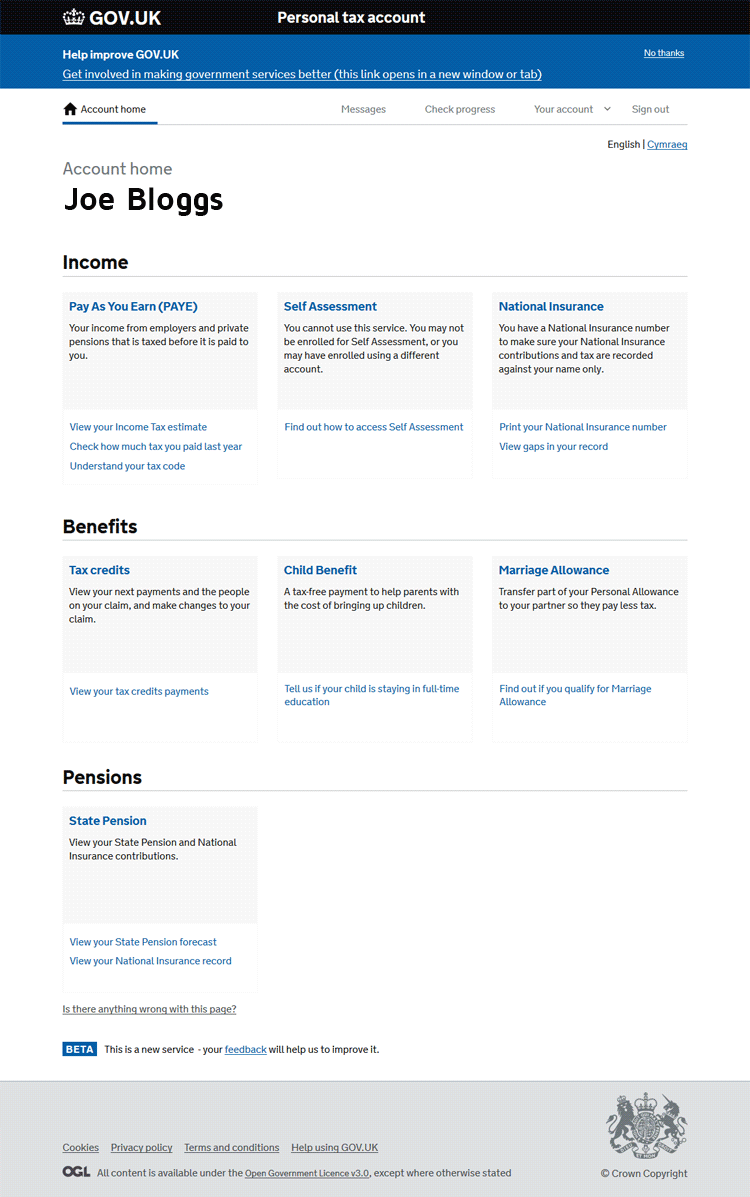

Once logged in you’ll be met with a screen similar to the image shown right, with your name at the top:

Once logged in you’ll be met with a screen similar to the image shown right, with your name at the top:

As you can see, it contains several sections. From your Personal Tax Account, you can:

- Check your PAYE tax code, see an estimate of the Income Tax you’ll pay and more;

- Check your Self Assessment details (or enrol) and view personal tax returns submitted in the past;

- View your National Insurance record;

- Check and amend your Tax Credits record;

- Tell HMRC about any changes that might affect any Child Benefit you receive (e.g. tell HMRC if your child is staying in education or training if they were aged 16 on or before 31 August);

- View and potentially update details about any Marriage Allowance if applicable to you (if you’re married or in a civil partnership and earn less than £11,500 you may be eligible);

- View an entire history of your National Insurance (NI) contributions;

- Check when you can claim your State Pension;

- See a forecast of how much you may receive for your State Pension when the time comes.

You can also: Read more