Where possible, Taxfile customers are urged to submit their records to Taxfile before December 1st 2014 so as to beat the price increases which will come into effect from that date. Taxfile has held its prices for several years now, and unusually long for our industry, however every so often we have to take stock and catch up with inflation and the ever-increasing costs of operating a business inside London. At time of writing, Taxfile customers still have time to submit their paperwork and records for professional tax and accountancy help – for example for tax returns – so can totally avoid the price increases this year if they act reasonably fast and get their figures and records etc. to us before December 1st. This will also avoid bottlenecks as we fast approach the busiest time in the tax year. Taxfile will also be sending out reminders to its active customer database.

Where possible, Taxfile customers are urged to submit their records to Taxfile before December 1st 2014 so as to beat the price increases which will come into effect from that date. Taxfile has held its prices for several years now, and unusually long for our industry, however every so often we have to take stock and catch up with inflation and the ever-increasing costs of operating a business inside London. At time of writing, Taxfile customers still have time to submit their paperwork and records for professional tax and accountancy help – for example for tax returns – so can totally avoid the price increases this year if they act reasonably fast and get their figures and records etc. to us before December 1st. This will also avoid bottlenecks as we fast approach the busiest time in the tax year. Taxfile will also be sending out reminders to its active customer database.

** New – Early Bird Reduction **

* If you miss the December 1st deadline, don’t worry because we’re offering a 5% ‘Early Bird’ reduction on prevailing Taxfile prices if you submit all your records to us before the end of December.

Call 020 8761 8000, click here to contact us or book an appointment online.

Taxfile would like to thank its customers for their loyalty and custom throughout the years, and for their understanding when occasionally we have to make these increases so as to keep pace with the rising cost of operating in London.

(For tax returns, figures and records are required for the year ending 5 April 2014).

If you are happy with our service we’d love to hear more about your experience with Taxfile as we are putting together a page of customer testimonials on our website(s). They need only be short if you haven’t got much time, but longer comments are fine too! As a thank you, you’ll receive a £10 off voucher which you can offset against your next Taxfile bill. Please submit your testimonial here. Many thanks!

If you are happy with our service we’d love to hear more about your experience with Taxfile as we are putting together a page of customer testimonials on our website(s). They need only be short if you haven’t got much time, but longer comments are fine too! As a thank you, you’ll receive a £10 off voucher which you can offset against your next Taxfile bill. Please submit your testimonial here. Many thanks!

HMRC are constantly reviewing who has and has not declared income properly from letting out property, whether that’s from short-term lets, long-term lets, holiday lets, letting rooms to students or to workforces. And with new, sophisticated, data sharing systems now in full force across many agencies, authorities, online, via tip-offs and surveillance, the Government has its sights on an estimated 1.5 million landlords who they think have under-paid tax.

HMRC are constantly reviewing who has and has not declared income properly from letting out property, whether that’s from short-term lets, long-term lets, holiday lets, letting rooms to students or to workforces. And with new, sophisticated, data sharing systems now in full force across many agencies, authorities, online, via tip-offs and surveillance, the Government has its sights on an estimated 1.5 million landlords who they think have under-paid tax.

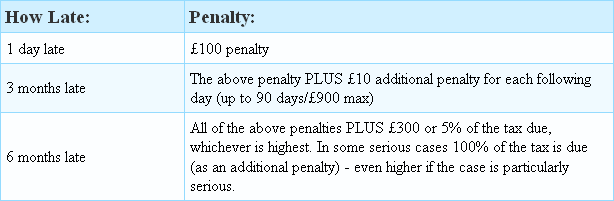

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.

Where possible, Taxfile customers are urged to submit their records to Taxfile before December 1st 2014 so as to beat the price increases which will come into effect from that date. Taxfile has held its prices for several years now, and unusually long for our industry, however every so often we have to take stock and catch up with inflation and the ever-increasing costs of operating a business inside London. At time of writing, Taxfile customers still have time to submit their paperwork and records for professional tax and accountancy help – for example for tax returns – so can totally avoid the price increases this year if they act reasonably fast and get their figures and records etc. to us before December 1st. This will also avoid bottlenecks as we fast approach the busiest time in the tax year. Taxfile will also be sending out reminders to its active customer database.

Where possible, Taxfile customers are urged to submit their records to Taxfile before December 1st 2014 so as to beat the price increases which will come into effect from that date. Taxfile has held its prices for several years now, and unusually long for our industry, however every so often we have to take stock and catch up with inflation and the ever-increasing costs of operating a business inside London. At time of writing, Taxfile customers still have time to submit their paperwork and records for professional tax and accountancy help – for example for tax returns – so can totally avoid the price increases this year if they act reasonably fast and get their figures and records etc. to us before December 1st. This will also avoid bottlenecks as we fast approach the busiest time in the tax year. Taxfile will also be sending out reminders to its active customer database.