Missed the Tax Return Deadline?

[Updated 3 February 2020]: If you missed the deadline for submission of your tax return to HMRC (that was 12 midnight on Saturday 31 January) here’s what you can expect in terms of a fine:

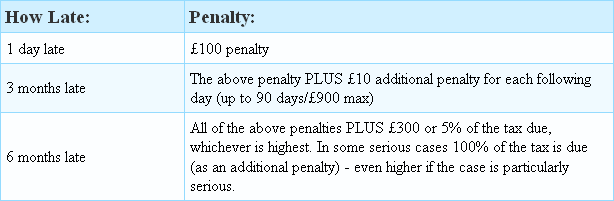

In case you didn’t realise, you still had to submit a tax return even if you did not owe any tax and the longer you leave it, the more it will cost you — as you can see in the table above. Alternatively, use this excellent estimation tool to work out your exact penalty at any given point in time. Not sure if you even need to submit a Self Assessment tax return? No problem; there’s a tool for that too (here).

Statistically speaking, women seem to send in their returns on time more often than men; 18 to 20 year olds of either sex are the very worst with around 11% of them sending in their returns late in recent years, while those over 65 seem to be statistically the most reliable of all, with only around 1½% of them having filed tax returns late. We’ll have to wait and see how it panned out this year when the figures are in.

Taxfile are here for you if you need to get your tax return sorted out whether you’re on time or not – but the earlier the better if you’re to minimise any penalty from HMRC. We are professional accountants and tax advisors, are based in South London, and will help to get your tax affairs in order with minimal fuss. We will ensure that all your figures are correct so that you pay only the right amount of tax – no more, and no less. For professional tax help contact us or book an appointment on-line.

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.

[UPDATED AUGUST 2020] Did you know that you get an automatic £100 minimum penalty if you file your Self Assessment tax return (or pay any tax owed) even one day late? After 3 months you can add £10 per day extra to that fine (up to 90 days/£900 max) and after 6 months it gets significantly worse. And remember that you need to file your return on time even if you don’t owe any tax, or if you have already paid it! Latest indications are that there are also no warnings given by HMRC. See the table below for the detail.

Part of the Chancellor’s recent Budget included plans to recover tax owed to the Treasury direct from the debtor’s bank account — all done directly and without a Court Order being necessary. This has been criticised widely but HMRC says that only 17,000 people in the UK per year would fall into this potential scenario and that it would only occur for those owing more than £1,000 in unpaid tax or tax credits owed. Moreover they say that they would only target long-standing tax debts from those who had received a minimum of 4 payment demands and whose bank and savings accounts combined had a minimum total balance of £5,000 or more remaining after any tax bad been directly seized. Also the debtor involved will have been issued with a final warning period of 14 days, during which the funds concerned would be frozen, before any tax was directly withdrawn.

Part of the Chancellor’s recent Budget included plans to recover tax owed to the Treasury direct from the debtor’s bank account — all done directly and without a Court Order being necessary. This has been criticised widely but HMRC says that only 17,000 people in the UK per year would fall into this potential scenario and that it would only occur for those owing more than £1,000 in unpaid tax or tax credits owed. Moreover they say that they would only target long-standing tax debts from those who had received a minimum of 4 payment demands and whose bank and savings accounts combined had a minimum total balance of £5,000 or more remaining after any tax bad been directly seized. Also the debtor involved will have been issued with a final warning period of 14 days, during which the funds concerned would be frozen, before any tax was directly withdrawn. HMRC (Her Majesty’s Revenue & Customs) has announced some new initiatives over the course of the last month and one of these is The Let Property campaign which is a campaign designed to recover undeclared tax from those receiving income from residential property lets. The idea is to encourage those landlords with under-declared income or gains (potentially including income tax, Capital Gains Tax and VAT) to contact them in order to make a full disclosure. By doing so they may well avoid the higher penalties which may be applied to them should HMRC discover the undeclared income/gains via other means. Don’t forget that they now have access to information shared across systems, including in relation to properties both at home and abroad, as well as being gained through their digital intelligence system ‘Connect’ which identifies links between individuals, entities and properties. So the message to landlords is loud and clear!

HMRC (Her Majesty’s Revenue & Customs) has announced some new initiatives over the course of the last month and one of these is The Let Property campaign which is a campaign designed to recover undeclared tax from those receiving income from residential property lets. The idea is to encourage those landlords with under-declared income or gains (potentially including income tax, Capital Gains Tax and VAT) to contact them in order to make a full disclosure. By doing so they may well avoid the higher penalties which may be applied to them should HMRC discover the undeclared income/gains via other means. Don’t forget that they now have access to information shared across systems, including in relation to properties both at home and abroad, as well as being gained through their digital intelligence system ‘Connect’ which identifies links between individuals, entities and properties. So the message to landlords is loud and clear!