Setting Up for Making Tax Digital

by Sue at Taxfile.

Whether you’re new to self-employment and have just started to run your own business, or have been doing it for a while – the fact is: Making Tax Digital (‘MTD’) is coming and it would be best to get set up in the right way, now.

Record-Keeping for Making Tax Digital

Keeping your personal life & your business completely separate is the best policy. It keeps things streamlined and will also save you money when your tax agent comes to do your bookkeeping & tax returns. So:

- Set up a separate bank account just for your business;

- Pay for your expenses from this account;

- Pay income from your sales into it;

- Keep an ongoing file for each tax year, where you put all your expenses, receipts & invoices;

- Include copies of your sales invoices in that file too;

- Keep the file in monthly order, so that accountants/tax advisors like Taxfile can easily cross-check the invoices to the bank statements and analyse your costs accurately.

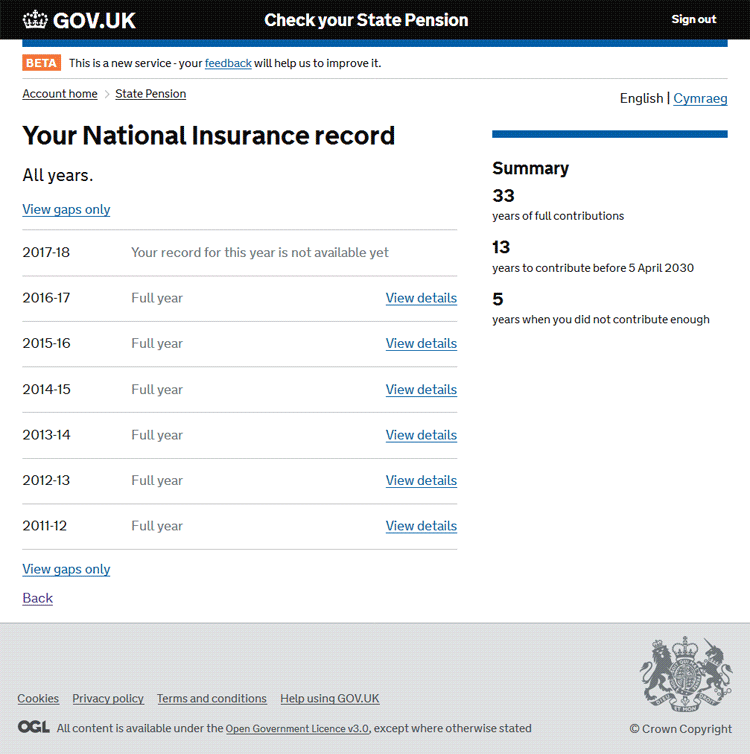

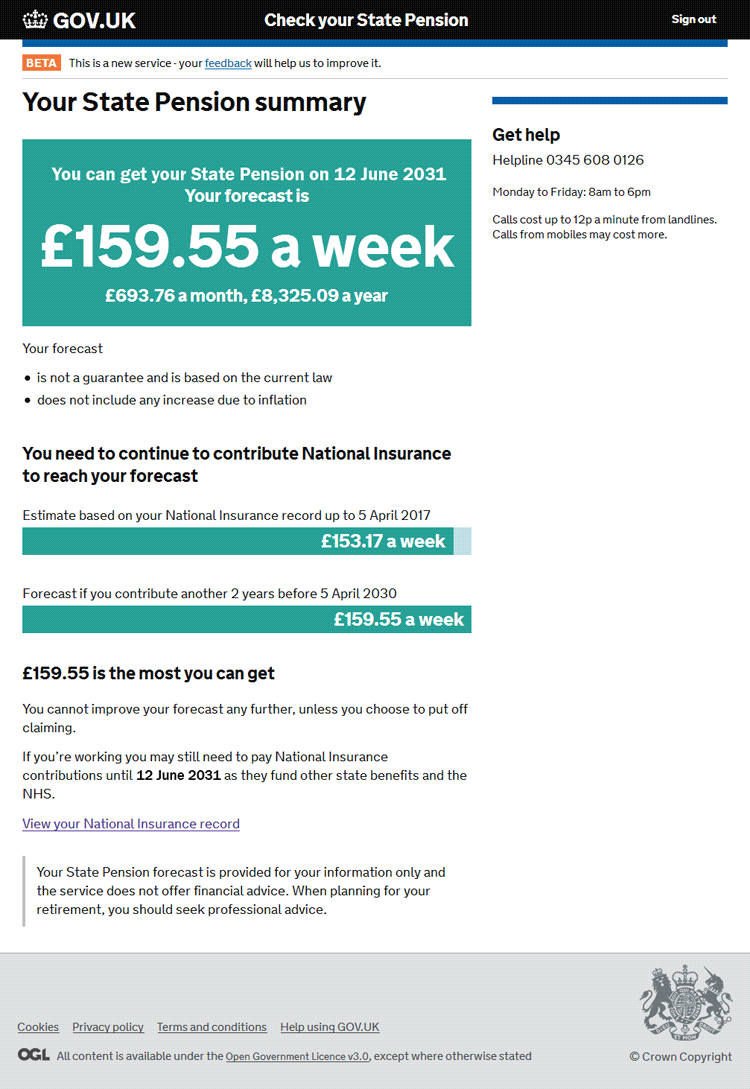

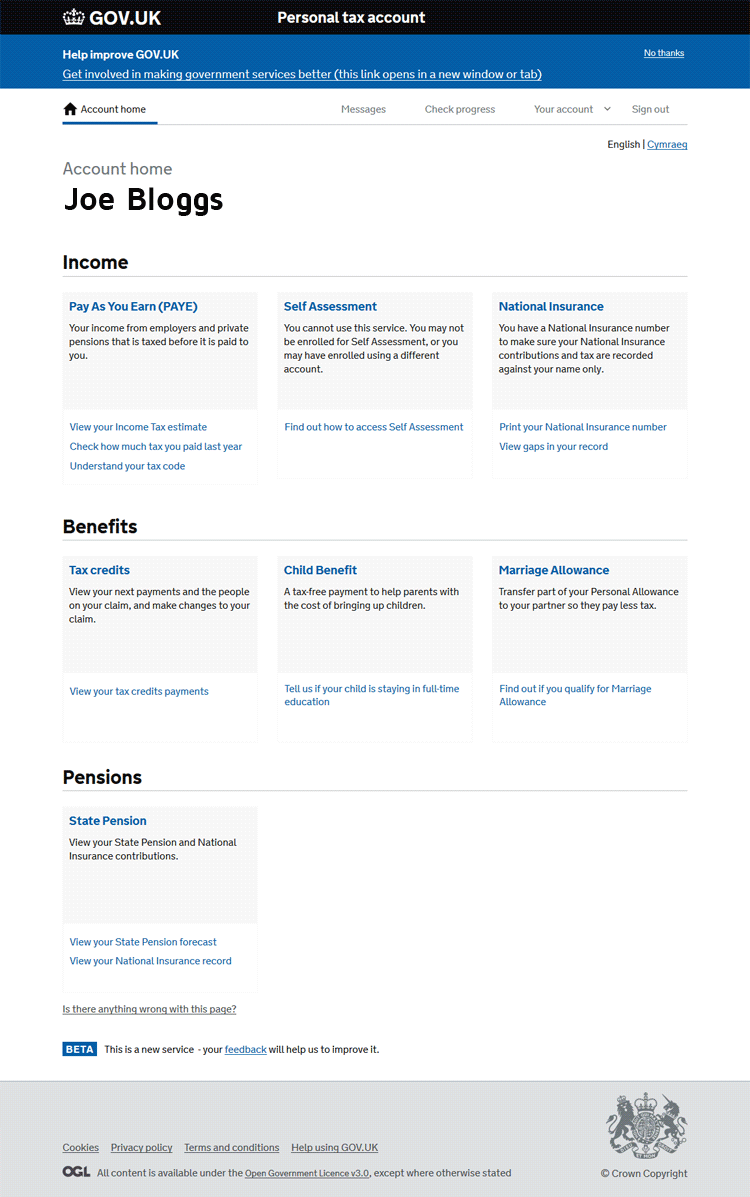

Setting Up Digitally

Making Tax Digital means that you must run your business through a digital traceable source. The best way to do this is to allow us, if we are your tax agent/accountant, to set up your bank statements to feed automatically into accounting software like ‘Xero’. Alternatively, we can accept bank statements downloaded in CSV format, which we would then transfer to Excel spreadsheets.

Cash & Card Sales

If you are making cash & card sales, set up an app on your smartphone like ‘Sum Up’ or ‘Square’ so that you will be complying with MTD – your bank can also supply you with a PDQ card reader to accept your cash/card sales. We can upload your sales reports from these services and include them in your sales figures.

Accurate record-keeping is the cornerstone of every successful business

Moving to Quarterly Reporting

Here at Taxfile, we can currently run your bookkeeping for you quarterly or annually. However, when HMRC implement MTD fully in 2026, tax returns will need to be submitted each quarter — no longer just once a year. We’re therefore recommending that everyone gets used to sending in their bookkeeping records quarterly.

Quarterly bookkeeping also allows us to monitor your sales turnover and alert you at the appropriate time if you are approaching the level of sales that would require you to get registered for VAT. Finding out at the end of the year that you have already gone over the threshold — and should have been charging VAT at an earlier date — can be very costly.

Contact Taxfile – for All Your Tax & Accounting Needs

We’re Tax Advisors & Accountants in Tulse Hill, Dulwich, South London & the South West

Come and chat with one of our friendly team in the Tulse Hill office about getting things set up & ready in good time. Or call for a telephone appointment to discuss what will be best suited to your particular business operations.

Whether you are a sole trader with no staff or subcontractors for a larger concern, we are here to help every size of business get set up on the right path — for getting MTD-ready.

Taxfile is a tax advisor and accountant with offices in Tulse Hill, and Dulwich in South London, and Devon & Cornwall in the South West of England.

Welcome to Taxfile’s Autumn Newsletter for 2021. One of our biggest yet, it includes useful tax- and accountancy-related news that you need to be aware of, ways to save time or money – and much more. Take a look!

Welcome to Taxfile’s Autumn Newsletter for 2021. One of our biggest yet, it includes useful tax- and accountancy-related news that you need to be aware of, ways to save time or money – and much more. Take a look! You’ll find QR codes throughout the newsletter. These are a quick and easy way to access further information about the topic. Assuming you are viewing the newsletter on a desktop device or a printed* version, simply point your mobile camera phone at a QR code and then open the link that pops up. Your mobile’s browser will then take you straight to the information page. Alternatively, we supply simple link URLs to simply tap in.

You’ll find QR codes throughout the newsletter. These are a quick and easy way to access further information about the topic. Assuming you are viewing the newsletter on a desktop device or a printed* version, simply point your mobile camera phone at a QR code and then open the link that pops up. Your mobile’s browser will then take you straight to the information page. Alternatively, we supply simple link URLs to simply tap in.