Taxfile are Finalists in the British Accountancy Awards 2016

Taxfile are delighted to confirm that they’ve been nominated as Finalists in the sixth annual British Accountancy Awards taking place in November 2016. With a real chance of winning the Independent Firm of the Year, Greater London category, all the staff at Taxfile should take this as a pat on the back for their expertise and diligence looking after the tax affairs of clients in the Greater London region. “It’s a great honour!” said Guy Bridger, Taxfile’s Managing Director, who wanted to draw attention to the particularly hard work of Julie, Faiz, Ewelina and Ali on the Taxfile team. The awards ceremony takes place at The Brewery, London EC1, on 29 November.

Taxfile are delighted to confirm that they’ve been nominated as Finalists in the sixth annual British Accountancy Awards taking place in November 2016. With a real chance of winning the Independent Firm of the Year, Greater London category, all the staff at Taxfile should take this as a pat on the back for their expertise and diligence looking after the tax affairs of clients in the Greater London region. “It’s a great honour!” said Guy Bridger, Taxfile’s Managing Director, who wanted to draw attention to the particularly hard work of Julie, Faiz, Ewelina and Ali on the Taxfile team. The awards ceremony takes place at The Brewery, London EC1, on 29 November.

Taxfile can add this to their already impressive list of previous accolades which include being a Finalist in the Award for Innovation and winner of the Best Small Business award. Our congratulations to all staff and best wishes to all accountancy companies taking part — it should be a night to remember!

Taxfile are accountants and tax advisors with London offices in both Tulse Hill and Dulwich in SE21. We can help with anything from simple bookkeeping, payroll, tax returns, tax refunds, VAT, National Insurance and Corporation Tax to full accounts work for limited companies, help with auto enrolment duties as well as sorting out complex tax problems. Read more

[UPDATE: Please note that this offer has now expired]. Taxfile’s customers can benefit from an incredible offer on a range of Sage accounting packages at the moment. We’re offering a FREE or, in effect, heavily subsidised* Sage accounting package to all active Taxfile customers, whether existing or new. There are various different packages available so we’re sure we’ll have one which will suit every customer perfectly. The list of benefits is almost endless — here are just a few:

[UPDATE: Please note that this offer has now expired]. Taxfile’s customers can benefit from an incredible offer on a range of Sage accounting packages at the moment. We’re offering a FREE or, in effect, heavily subsidised* Sage accounting package to all active Taxfile customers, whether existing or new. There are various different packages available so we’re sure we’ll have one which will suit every customer perfectly. The list of benefits is almost endless — here are just a few:

Hosts who rent out a spare room could soon see themselves being straddled with an unexpected tax bill if companies like ‘Airbnb’ are forced to share data with UK authorities.

Hosts who rent out a spare room could soon see themselves being straddled with an unexpected tax bill if companies like ‘Airbnb’ are forced to share data with UK authorities.

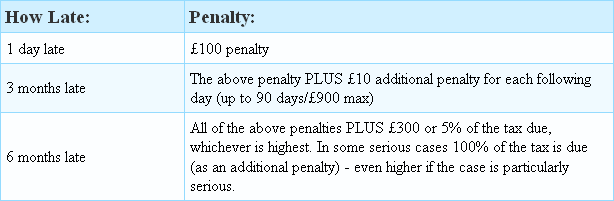

If you still haven’t filed your tax return for the financial year up to 5 April 2014 you can expect the penalties from HMRC to begin racking up daily — and potentially very significantly — starting from Friday 1 May.

If you still haven’t filed your tax return for the financial year up to 5 April 2014 you can expect the penalties from HMRC to begin racking up daily — and potentially very significantly — starting from Friday 1 May.

HMRC have recently been targeting tax agents who file high volumes of tax returns and, as one of the UK’s top 100 tax return preparers by volume, Taxfile had the honour of having an inspection by HMRC inspectors during late October.

HMRC have recently been targeting tax agents who file high volumes of tax returns and, as one of the UK’s top 100 tax return preparers by volume, Taxfile had the honour of having an inspection by HMRC inspectors during late October. If you are happy with our service we’d love to hear more about your experience with Taxfile as we are putting together a page of customer testimonials on our website(s). They need only be short if you haven’t got much time, but longer comments are fine too! As a thank you, you’ll receive a £10 off voucher which you can offset against your next Taxfile bill. Please submit your testimonial

If you are happy with our service we’d love to hear more about your experience with Taxfile as we are putting together a page of customer testimonials on our website(s). They need only be short if you haven’t got much time, but longer comments are fine too! As a thank you, you’ll receive a £10 off voucher which you can offset against your next Taxfile bill. Please submit your testimonial  Do you have online banking? Sending us downloaded statement information straight from your online banking means we can more easily import the data into our system and check for expenses and income which might otherwise have been overlooked. It can also fill in the gaps where you are missing receipts or invoices. This simple service could therefore save both time and money! Most online banking platforms allow you to export this information, for example as a CSV file, and this format is perfect for our accounting system.

Do you have online banking? Sending us downloaded statement information straight from your online banking means we can more easily import the data into our system and check for expenses and income which might otherwise have been overlooked. It can also fill in the gaps where you are missing receipts or invoices. This simple service could therefore save both time and money! Most online banking platforms allow you to export this information, for example as a CSV file, and this format is perfect for our accounting system.