AMAZING OFFER! Save Time, Money & Space with a FREE Sage Bookkeeping & Accounts Package!*

[UPDATE: Please note that this offer has now expired]. Taxfile’s customers can benefit from an incredible offer on a range of Sage accounting packages at the moment. We’re offering a FREE or, in effect, heavily subsidised* Sage accounting package to all active Taxfile customers, whether existing or new. There are various different packages available so we’re sure we’ll have one which will suit every customer perfectly. The list of benefits is almost endless — here are just a few:

[UPDATE: Please note that this offer has now expired]. Taxfile’s customers can benefit from an incredible offer on a range of Sage accounting packages at the moment. We’re offering a FREE or, in effect, heavily subsidised* Sage accounting package to all active Taxfile customers, whether existing or new. There are various different packages available so we’re sure we’ll have one which will suit every customer perfectly. The list of benefits is almost endless — here are just a few:

- Firstly we’ll GIVE* Taxfile customers the package — you don’t have to pay Sage at all;

- Say hello to quick and easy bookkeeping and record-keeping;

- Quick and easy cash flow management tools;

- Cloud-based record keeping means you can access accounts records from anywhere with an internet connection;

- Automatic bank statement integration makes bank reconciliation a breeze, helping when receipts go missing and even recognising – and accounting for – regular transactions;

- A mobile app module allows you to simply snap a photo of your receipt and it uploads to your Sage account (say goodbye to physical receipt storage!);

- Less paperwork!

- Automatic tax computations performed by the software;

- Report and analysis options;

- VAT handling;

- Automatic VAT return options (or let us handle it for you as you prefer);

- Shows you the taxes and National Insurance due so you can easily pay them on time;

- Fast and easier tax returns;

- Help from Taxfile at any point and from Sage’s own helpful videos;

- Helps you stay in line with UK laws, taxes and regulations;

- No experience needed;

- Perfect for the self-employed, start-ups and small businesses;

- Taxfile will even be happy to set you up;

- Integrated invoicing and quotation options available (even from your mobile phone!);

- A quick and easy payroll bolt-on is also available for limited companies, with payslips, RTI, Auto Enrolment integration etc.;

- Auto enrolment communications included if you have a company pension scheme;

- Option to automatically integrate online e-commerce records into your Sage account;

- Fast and easier company accounts preparation;

- … and much more!

But there is more major benefit – collaboration with us, your accountant!

The Sage packages we supply are not only free, or in effect heavily subsidised depending on the package involved, but also allow us, your accountant and tax adviser, to collaborate with you within your Sage package with your permission. So where you cannot do something yourself, we can log in using our own integrated Sage administration system to get involved on your behalf, for example to set things up for you, run reports, activate VAT returns, tax returns, end of year accounts, payroll and so on. It’s amazing really! So you do as much or as little as you want to … and we cover everything else!

You save money!

Using the easy but powerful Sage bookkeeping and accounting packages supplied by Taxfile

means that you’ll save money. It’s as simple as that. Customers using such packages makes our job easier, reducing our chargeable hours working on your accounts, so quite simply saves you money!

You also save time!

Our Sage packages will save you SO much time you’ll never look back! Once you’ve tried our Sage packages for a while you’ll Read more

TaxFile are offering a 5% reduction for clients who can submit their accounts to us before December 21st this year. This helps both of us — you receive a 5% reduction in your bill and it eases the rush in the New Year, our busiest time.

TaxFile are offering a 5% reduction for clients who can submit their accounts to us before December 21st this year. This helps both of us — you receive a 5% reduction in your bill and it eases the rush in the New Year, our busiest time.

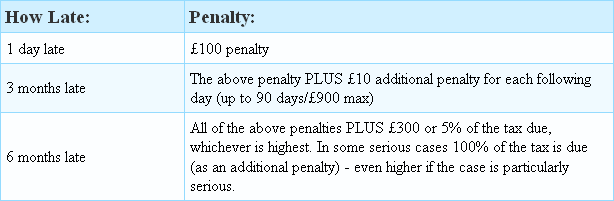

If you still haven’t filed your tax return for the financial year up to 5 April 2014 you can expect the penalties from HMRC to begin racking up daily — and potentially very significantly — starting from Friday 1 May.

If you still haven’t filed your tax return for the financial year up to 5 April 2014 you can expect the penalties from HMRC to begin racking up daily — and potentially very significantly — starting from Friday 1 May.

HMRC have recently been targeting tax agents who file high volumes of tax returns and, as one of the UK’s top 100 tax return preparers by volume, Taxfile had the honour of having an inspection by HMRC inspectors during late October.

HMRC have recently been targeting tax agents who file high volumes of tax returns and, as one of the UK’s top 100 tax return preparers by volume, Taxfile had the honour of having an inspection by HMRC inspectors during late October. Do you have online banking? Sending us downloaded statement information straight from your online banking means we can more easily import the data into our system and check for expenses and income which might otherwise have been overlooked. It can also fill in the gaps where you are missing receipts or invoices. This simple service could therefore save both time and money! Most online banking platforms allow you to export this information, for example as a CSV file, and this format is perfect for our accounting system.

Do you have online banking? Sending us downloaded statement information straight from your online banking means we can more easily import the data into our system and check for expenses and income which might otherwise have been overlooked. It can also fill in the gaps where you are missing receipts or invoices. This simple service could therefore save both time and money! Most online banking platforms allow you to export this information, for example as a CSV file, and this format is perfect for our accounting system.