What does it mean to be a Director?

Your obligations as a Director can be ‘taxing’.

Running a successful limited company typically involves administrative duties outlined by Companies House & HMRC. As the director you’ll also be responsible for ensuring the finances of the company are regulated and healthy. At Taxfile we can help you focus on growing your business and take care of all your accounting needs.

In order to fulfil your obligations, after your limited company’s financial year comes to a close, it must prepare a set of final accounts and a company corporation tax return.

The company’s final accounts are prepared from the company’s financial records for the period that covers your company’s financial year and must include:

- a balance sheet showing the value of everything the company owns, owes and is owed on the last day of the financial year

- a profit and loss account showing the company’s sales against its running costs and highlighting the profit or loss it has made over the financial year

- notes about the accounts

- a director’s report (unless you’re a ‘micro-entity’)

The accounts must either meet ‘International Financial Reporting Standards’ or ‘New UK Generally Accepted Accounting Practice’.

At Taxfile we can provide support for small to medium businesses that require accountants to compile and file their full company accounts ready for the shareholders, people of significance to the company, Companies House and HMRC as part of your company corporation tax return.

We can assist you with the bookkeeping and bank reconciliation to ensure that your accounting records are complete and include:

- all money received and spent by the company

- details of assets owned by the company

- debts the company owes or is owed

- stock the company owns at the end of the financial year

- all goods bought and sold

As the director you are solely responsible that your accounts and tax return meet the deadlines for filing with Companies House and HMRC. From the accounts you can also deduce how much Corporation Tax to pay. The dates you will need to remember:

- File the first set of accounts with Companies House 12 months after the date you registered with Companies House

- File annual accounts with Companies House 9 months after your company’s financial year ends

- Pay Corporation Tax or tell HMRC that your limited company does not owe any 9 months and 1 day after your ‘accounting period’ for Corporation Tax ends

- File a Company Tax Return 12 months after your accounting period for Corporation Tax ends

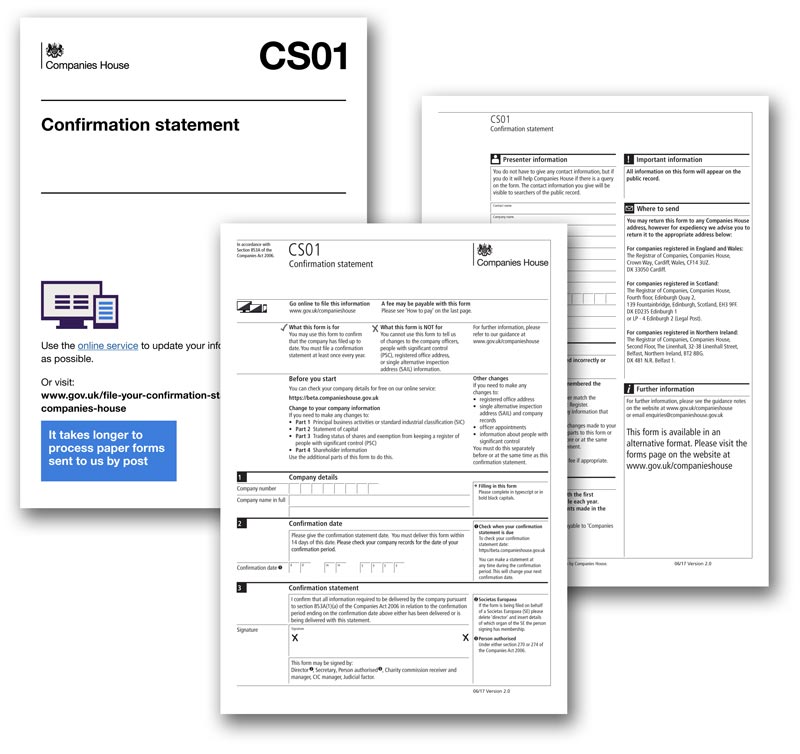

- File a Confirmation Statement 12 months after: company incorporated, company accounts submitted, or last confirmation statement

As a Director do I need to file a Self-Assessment Income Tax Return?

See our blog HERE

If you are thinking about setting up a limited company we are offering a special price of £375+VAT for the following;

- company formation (including the option to have the company phrased as a special purpose vehicle for a property rental company)

- we will register a single director with HMRC for self-assessment

- we set up the payroll scheme

- we arrange your chart of accounts on online software and set up the bank feed so transactions are automatically recorded

For more information about any of our tax- and accountancy-related services, call us on 020 8761 8000.