It’s now time to start the process of claiming your tax refund if you are a subcontractor working within the construction industry and have been paying tax, in advance, through the Construction Industry Scheme (‘CIS’). In this article we will tell you how you qualify and how to claim your tax refund. First, though, a little bit of background to the scheme:

It’s now time to start the process of claiming your tax refund if you are a subcontractor working within the construction industry and have been paying tax, in advance, through the Construction Industry Scheme (‘CIS’). In this article we will tell you how you qualify and how to claim your tax refund. First, though, a little bit of background to the scheme:

The CIS Scheme

The Construction Industry Scheme, or CIS, is a scheme whereby a contractor in the construction industry usually deducts a proportion of the money due to their subcontractor, at source. The deducted amount is then passed direct to HMRC and counts towards the subcontractor’s tax and National Insurance, the tax element effectively being paid in advance. The exact proportion deducted depends on whether the subcontractor concerned has registered under the CIS system. If the subcontractor has not registered, the deduction will usually be made at a rate of 30%. If they have already registered, then the deduction will usually be made at a rate of 20%. Either way, by the financial year end, the amount of tax deducted at source will usually end up being more than they really needed to have paid, simply because it won’t have factored in the personal allowance which every UK taxpayer is entitled to (most UK citizens can earn up to £10,000 before paying tax at time of writing, this figure being set to rise to £10,600 in the tax year 2015-16, 10,800 a year later then increasing to £11,000 by 2017-18 following the recent budget proposals). Hence, many subcontractors in the construction industry will be due a tax refund because of the overpayment. The good news is that the time to apply for the refund is pretty much now, so get in touch if you’d like our help claiming.

What kind of work does CIS cover?

You qualify to be in the CIS system if you are a subcontractor who supplies construction work to buildings. This includes labouring, decorating, site preparation and refurbishment but excludes things like architecture, surveying services, the hire of scaffolding without labour, the fitting of carpets, the delivery of materials, and finally non-construction type services such as site facilities (canteens etc.).

What if your business is not in the UK?

Even if your business is abroad, the same rules apply if you work as a subcontractor within the UK. However there are some slightly different rules regarding the treatment of taxation for non-resident workers from countries which have ‘Double Taxation’ treaties with the UK (we can, of course, also help with that — just get in contact).

Registering for CIS

If you haven’t already registered for CIS as a sub-contractor, Taxfile can help to do this for you. You’ll need to be registered for Self Assessment (we can also help with this) and this will give you your UTR (unique taxpayer reference) number. We’ll also need your name, National Insurance number, your legal business/trading name and contact details. Once registered with CIS one of the immediate benefits will be that you’ll then have tax deductions made at the 20% rate rather than at 30%, which would otherwise be the case. If your business is a legal partnership you will also need to register it for CIS but this would need to be done in addition to being registered as an individual or sole trader. Of course, Taxfile can help with that too. Once you have been registered with CIS and have passed certain eligibility criteria, it is also possible to apply for ‘gross payment status’ meaning that you’ll then be paid by the contractor without the usual ‘at source’ deductions. Instead you’ll need to pay any outstanding tax and National Insurance at the financial year end; however HMRC will review your business each year to check that you still qualify for this status (paying tax late and/or submitting returns late would put your gross payment status at risk).

Offsetting Expenses against your tax

Taxfile can also help you to offset certain expenses against your subcontractor income. This means that any tax refund will be larger — or any tax outstanding will be lower. We can offset Read more

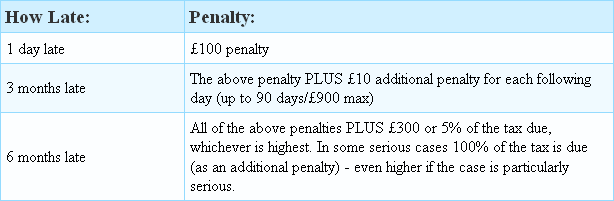

If you still haven’t filed your tax return for the financial year up to 5 April 2014 you can expect the penalties from HMRC to begin racking up daily — and potentially very significantly — starting from Friday 1 May.

If you still haven’t filed your tax return for the financial year up to 5 April 2014 you can expect the penalties from HMRC to begin racking up daily — and potentially very significantly — starting from Friday 1 May.

It’s now time to start the process of claiming your tax refund if you are a subcontractor working within the construction industry and have been paying tax, in advance, through the Construction Industry Scheme (‘CIS’). In this article we will tell you how you qualify and how to claim your tax refund. First, though, a little bit of background to the scheme:

It’s now time to start the process of claiming your tax refund if you are a subcontractor working within the construction industry and have been paying tax, in advance, through the Construction Industry Scheme (‘CIS’). In this article we will tell you how you qualify and how to claim your tax refund. First, though, a little bit of background to the scheme:

HMRC have recently been targeting tax agents who file high volumes of tax returns and, as one of the UK’s top 100 tax return preparers by volume, Taxfile had the honour of having an inspection by HMRC inspectors during late October.

HMRC have recently been targeting tax agents who file high volumes of tax returns and, as one of the UK’s top 100 tax return preparers by volume, Taxfile had the honour of having an inspection by HMRC inspectors during late October. If you are happy with our service we’d love to hear more about your experience with Taxfile as we are putting together a page of customer testimonials on our website(s). They need only be short if you haven’t got much time, but longer comments are fine too! As a thank you, you’ll receive a £10 off voucher which you can offset against your next Taxfile bill. Please submit your testimonial

If you are happy with our service we’d love to hear more about your experience with Taxfile as we are putting together a page of customer testimonials on our website(s). They need only be short if you haven’t got much time, but longer comments are fine too! As a thank you, you’ll receive a £10 off voucher which you can offset against your next Taxfile bill. Please submit your testimonial  HMRC are constantly reviewing who has and has not declared income properly from letting out property, whether that’s from short-term lets, long-term lets, holiday lets, letting rooms to students or to workforces. And with new, sophisticated, data sharing systems now in full force across many agencies, authorities, online, via tip-offs and surveillance, the Government has its sights on an estimated 1.5 million landlords who they think have under-paid tax.

HMRC are constantly reviewing who has and has not declared income properly from letting out property, whether that’s from short-term lets, long-term lets, holiday lets, letting rooms to students or to workforces. And with new, sophisticated, data sharing systems now in full force across many agencies, authorities, online, via tip-offs and surveillance, the Government has its sights on an estimated 1.5 million landlords who they think have under-paid tax.