Missed the Tax Return Deadline?

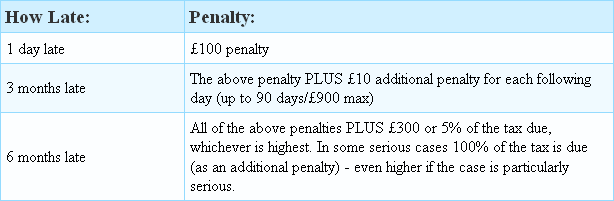

[Updated 3 February 2020]: If you missed the deadline for submission of your tax return to HMRC (that was 12 midnight on Saturday 31 January) here’s what you can expect in terms of a fine:

In case you didn’t realise, you still had to submit a tax return even if you did not owe any tax and the longer you leave it, the more it will cost you — as you can see in the table above. Alternatively, use this excellent estimation tool to work out your exact penalty at any given point in time. Not sure if you even need to submit a Self Assessment tax return? No problem; there’s a tool for that too (here).

Statistically speaking, women seem to send in their returns on time more often than men; 18 to 20 year olds of either sex are the very worst with around 11% of them sending in their returns late in recent years, while those over 65 seem to be statistically the most reliable of all, with only around 1½% of them having filed tax returns late. We’ll have to wait and see how it panned out this year when the figures are in.

Taxfile are here for you if you need to get your tax return sorted out whether you’re on time or not – but the earlier the better if you’re to minimise any penalty from HMRC. We are professional accountants and tax advisors, are based in South London, and will help to get your tax affairs in order with minimal fuss. We will ensure that all your figures are correct so that you pay only the right amount of tax – no more, and no less. For professional tax help contact us or book an appointment on-line.

[UPDATE: Please note that this offer has now expired]. Get Sage One Cashbook

[UPDATE: Please note that this offer has now expired]. Get Sage One Cashbook

HMRC have recently been targeting tax agents who file high volumes of tax returns and, as one of the UK’s top 100 tax return preparers by volume, Taxfile had the honour of having an inspection by HMRC inspectors during late October.

HMRC have recently been targeting tax agents who file high volumes of tax returns and, as one of the UK’s top 100 tax return preparers by volume, Taxfile had the honour of having an inspection by HMRC inspectors during late October. If you are happy with our service we’d love to hear more about your experience with Taxfile as we are putting together a page of customer testimonials on our website(s). They need only be short if you haven’t got much time, but longer comments are fine too! As a thank you, you’ll receive a £10 off voucher which you can offset against your next Taxfile bill. Please submit your testimonial

If you are happy with our service we’d love to hear more about your experience with Taxfile as we are putting together a page of customer testimonials on our website(s). They need only be short if you haven’t got much time, but longer comments are fine too! As a thank you, you’ll receive a £10 off voucher which you can offset against your next Taxfile bill. Please submit your testimonial  HMRC are constantly reviewing who has and has not declared income properly from letting out property, whether that’s from short-term lets, long-term lets, holiday lets, letting rooms to students or to workforces. And with new, sophisticated, data sharing systems now in full force across many agencies, authorities, online, via tip-offs and surveillance, the Government has its sights on an estimated 1.5 million landlords who they think have under-paid tax.

HMRC are constantly reviewing who has and has not declared income properly from letting out property, whether that’s from short-term lets, long-term lets, holiday lets, letting rooms to students or to workforces. And with new, sophisticated, data sharing systems now in full force across many agencies, authorities, online, via tip-offs and surveillance, the Government has its sights on an estimated 1.5 million landlords who they think have under-paid tax. Do you have online banking? Sending us downloaded statement information straight from your online banking means we can more easily import the data into our system and check for expenses and income which might otherwise have been overlooked. It can also fill in the gaps where you are missing receipts or invoices. This simple service could therefore save both time and money! Most online banking platforms allow you to export this information, for example as a CSV file, and this format is perfect for our accounting system.

Do you have online banking? Sending us downloaded statement information straight from your online banking means we can more easily import the data into our system and check for expenses and income which might otherwise have been overlooked. It can also fill in the gaps where you are missing receipts or invoices. This simple service could therefore save both time and money! Most online banking platforms allow you to export this information, for example as a CSV file, and this format is perfect for our accounting system. [UPDATED]: Calling all subbies! Claim your refund in time for Christmas AND get a 5% discount on Taxfile prices if you submit your records to us before 21st December!

[UPDATED]: Calling all subbies! Claim your refund in time for Christmas AND get a 5% discount on Taxfile prices if you submit your records to us before 21st December!