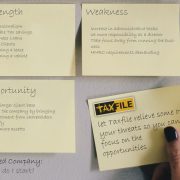

Need a Limited Company? Questions you may be asking yourself

“What are the main differences between being self-employed and running a limited company?”

“What are the advantages and disadvantages of having a private limited company?”

The major difference between running a private limited company and being self-employed are the administrative requirements you are required to do by law & although the volume is more, the data contained within those returns are pretty similar to being a sole trader.

A limited company will:

- need to keep company records

- report any changes to Companies House & HMRC

- need to file an annual company tax return along with the company’s accounts, giving an undistorted view of its finances.

So why go through the extra cost and resources of having a Limited Company?

In forming a limited company, you are limiting your personal liability. What this means is that the Limited Company becomes a legal entity of its own. Think of it as another being, that you work for. However, it is important to keep in mind that you cannot abuse your power with the limited liability, to take selfish and unnecessary risks. As a director, you are ethically and morally responsible for the business decisions and transactions the company makes.

As a director of a private limited company you will:

- make decisions that benefit the company rather than your own

- abide by the rules and regulations outlined by the company Articles of Association, which are written rules about running the company agreed by the shareholders or guarantors, directors and the company secretary

- notify any shareholders if you might benefit personally from a company transaction

- always act with the intention of making the company successful.

Having a Limited company can also add professionalism to your business. This can help your business become even more successful because customers, clients, and B2B companies will be more inclined to trust you and buy your products or services if you are a limited company rather than a sole trader. It is quite common for B2B companies only to trade with another limited company as a general rule.

A final benefit is, if you have a profitable Limited Company, how you distribute salaries and dividends can have income tax savings, especially once your Read more

Sign Up & Your Favourite Charity Gets £25 Too!

Sign Up & Your Favourite Charity Gets £25 Too! Create and send invoices from within the software;

Create and send invoices from within the software;