A Personal Message from Guy Bridger at Taxfile

Dear Taxfile Client,

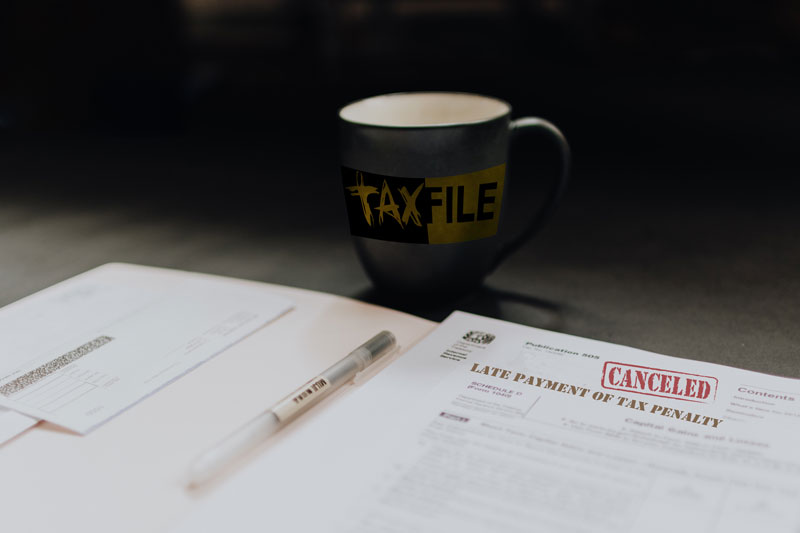

We’re aware that many people are struggling right now. So, I wanted to personally touch base with you to confirm that, although the official deadline for submission of 2020/21 self-assessment tax returns and tax payments is Monday (31 January), there is now some extra time this year. This is great news for you if you are concerned about missing the deadlines or having to pay an HMRC penalty for being late. It should really take the pressure off for those who are struggling or worried.

- For self-assessment tax returns, you now have until midnight on 28 February to submit. HMRC will only charge you a late filing fee if you file later than this.

- For self-assessment tax payments, you now have until 1 April to make your payment (or arrange an HMRC payment plan) before incurring an HMRC late tax payment surcharge. While you will still incur interest for late tax payments from 1 February, HMRC’s interest rate is only 2.75% per annum, so even a month’s interest is unlikely to equate to much for most people.

- For tax payments on account (payment in advance for the next tax year), there is no HMRC surcharge/penalty if you’re late but it does attract interest. However, again, that’s only at HMRC’s low rate, so is unlikely to amount to much for most.

We are here to help you, so don’t worry if you owe tax or are running late on your tax return. The Taxfile team can help you sort things out, particularly as we have a little longer than usual. We can work something out during February if you are worried about HMRC surcharges, interest and deadlines. Please get in touch if so.

Lastly, don’t forget that we are open on Saturdays during January and February (by appointment) and open later (until 6pm) on Mondays and Tuesdays. Read more

Welcome to Taxfile’s Autumn Newsletter for 2021. One of our biggest yet, it includes useful tax- and accountancy-related news that you need to be aware of, ways to save time or money – and much more. Take a look!

Welcome to Taxfile’s Autumn Newsletter for 2021. One of our biggest yet, it includes useful tax- and accountancy-related news that you need to be aware of, ways to save time or money – and much more. Take a look! You’ll find QR codes throughout the newsletter. These are a quick and easy way to access further information about the topic. Assuming you are viewing the newsletter on a desktop device or a printed* version, simply point your mobile camera phone at a QR code and then open the link that pops up. Your mobile’s browser will then take you straight to the information page. Alternatively, we supply simple link URLs to simply tap in.

You’ll find QR codes throughout the newsletter. These are a quick and easy way to access further information about the topic. Assuming you are viewing the newsletter on a desktop device or a printed* version, simply point your mobile camera phone at a QR code and then open the link that pops up. Your mobile’s browser will then take you straight to the information page. Alternatively, we supply simple link URLs to simply tap in.