Act NOW & get 5% Off 2019-20 Self-Assessment Tax Return Fees

Have you contacted us about your 2019-20 Self Assessment tax return yet?

If not, please get in touch early this month (November). You’ll save 5% or more¹ by acting right away. You’ll also avoid the coming bottleneck if you act now. So, please get in touch:

- Get started with your tax return here

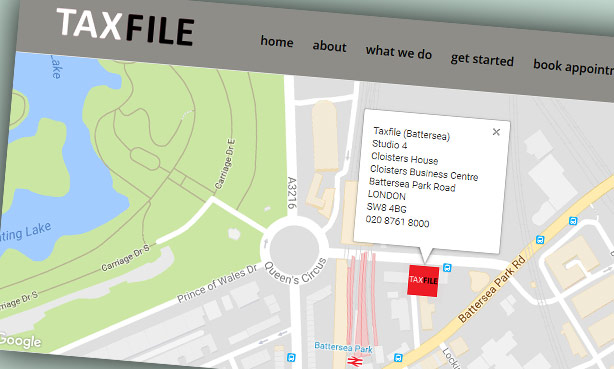

- or call 020 8761 8000

- or book an appointment² here

We’ll then confirm the next steps.

1. If you supply everything in time for us to submit your tax return by 30 November 2020, you’ll save 5% off our standard tax return fees. You’ll save even more compared to the higher prices that we’ll need to impose closer to the self-assessment deadline. Our prices will also increase very soon to cover weekend working and overtime to cater for those who leave it to the last minute. Please bear in mind that the pandemic lock-down will make things even harder than usual, so please act now and plan ahead.

2. Worried about COVID? There’s no need! We can do ‘virtual’ meetings instead, for example by telephone, Zoom, Teams, WhatsApp, Google Hangouts, Skype, Facetime or whatever suits you best. So, we don’t even need to meet face-to-face. Just give us a call on 020 8761 8000 to discuss your preferences. We’re here to help!

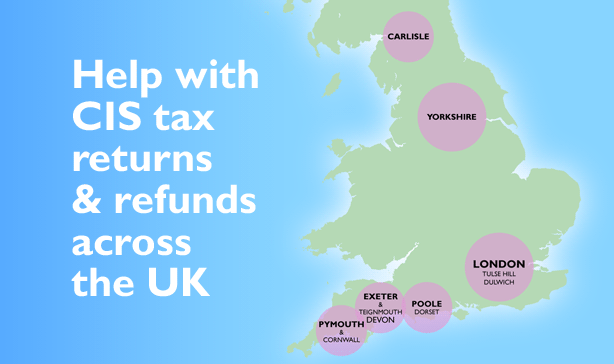

Taxfile are accountants and tax advisors in South London, with offices in Tulse Hill and Dulwich.

[Updated]: It’s common knowledge that most of Taxfile’s South London staff are multi-lingual but can you guess which staff member speaks no less than four languages fluently (Russian, Pashto, Dari and English) and which staff member is into both metal music and Irish dancing? And who should you ask for if you need payroll services? And who

[Updated]: It’s common knowledge that most of Taxfile’s South London staff are multi-lingual but can you guess which staff member speaks no less than four languages fluently (Russian, Pashto, Dari and English) and which staff member is into both metal music and Irish dancing? And who should you ask for if you need payroll services? And who